Climate Risk Analytics: A Game Changer for Real Estate

Stress is a natural human response to perceived threats or demands. It's a complex physiological and psychological process that can manifest in various ways, from mild anxiety to debilitating symptoms. Understanding the different types of stress, such as acute stress, chronic stress, and episodic acute stress, is crucial for developing effective coping mechanisms. Recognizing the early warning signs of stress in your body and mind can help you intervene before it escalates.

The Future of Real Estate Investment: A Data-Driven Approach

The Rise of Technology in Real Estate Investment

The real estate investment landscape is undergoing a dramatic transformation, driven by the rapid advancement of technology. From sophisticated data analytics platforms to automated property management systems, technology is streamlining every aspect of the investment process. This allows investors to make more informed decisions, access previously inaccessible markets, and potentially realize higher returns. This technological advancement is not just about convenience; it's about efficiency and the ability to analyze vast amounts of data to predict market trends with greater accuracy.

Real estate investment trusts (REITs) are also leveraging technology to enhance their operational efficiency. This leads to a more streamlined approach to managing properties, from maintenance to tenant relations. These developments are ultimately driving a more transparent and accessible market for both seasoned investors and newcomers.

Sustainable and Ethical Investments

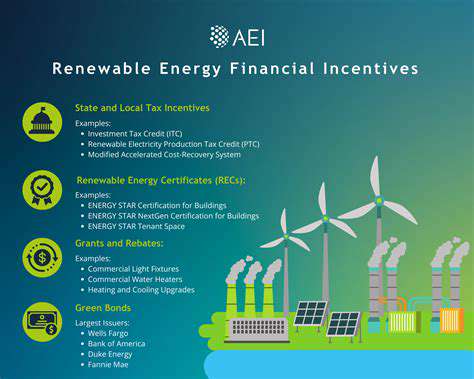

Growing societal awareness of environmental and social issues is significantly impacting real estate investment decisions. Investors are increasingly seeking properties that align with sustainable practices, from energy-efficient designs to environmentally friendly construction materials. This trend reflects a broader shift towards more responsible and ethical investment strategies.

The demand for green buildings and sustainable practices is also creating new investment opportunities in areas like renewable energy integration within properties. This growing emphasis on sustainability and ethical practices is poised to reshape the future of real estate investment, attracting a new generation of socially conscious investors.

The Impact of Globalization on Real Estate

Globalization is having a profound impact on the real estate market, with international investors increasingly seeking opportunities in diverse global markets. The ease of cross-border transactions and the availability of online platforms for international investment are making it easier than ever for investors to diversify their portfolios and access new opportunities beyond their local region. This trend is leading to a more interconnected and dynamic real estate market.

This interconnectedness also presents unique challenges and opportunities. Understanding and navigating international regulations, cultural nuances, and market fluctuations are crucial for success. Investors who can effectively adapt to these global dynamics will be best positioned to capitalize on emerging opportunities in the evolving global landscape.

The Role of AI in Property Valuation and Management

Artificial intelligence (AI) is poised to revolutionize property valuation and management. AI algorithms can analyze vast amounts of data, including market trends, property characteristics, and economic indicators, to provide more accurate and comprehensive valuations. This level of precision allows for a more data-driven investment strategy, leading to potentially higher returns.

Moreover, AI is automating property management tasks, from routine maintenance to tenant communication. This automation leads to significant cost savings and efficiency improvements. This streamlining of processes will benefit both individual investors and large institutional players. These advancements could lead to a significant shift in how real estate is valued and managed in the future.

Read more about Climate Risk Analytics: A Game Changer for Real Estate

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy