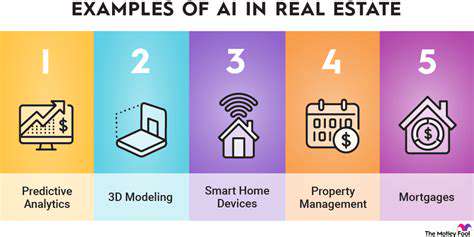

The Evolution of AI in Real Estate Valuation Models

Deep Learning for Predictive Modeling

Deep learning, a subset of machine learning, leverages artificial neural networks with multiple layers to analyze complex data patterns. In real estate valuation, deep learning models can process vast datasets comprising property features, market trends, and comparable sales. This advanced technique allows for the identification of intricate relationships between various factors, leading to more accurate and nuanced predictions of property values. By considering a wider range of variables and their intricate interactions, deep learning models can better capture the nuances of the real estate market, going beyond the limitations of simpler models. Deep learning's ability to automatically extract features from raw data significantly improves the accuracy and reliability of valuation estimates.

The use of deep learning models in real estate valuation allows for a more comprehensive understanding of the market dynamics. This can be particularly useful in identifying emerging trends and anticipating future price fluctuations. The intricate nature of real estate markets often involves complex interactions, which traditional methods struggle to capture effectively. This is where deep learning excels. It can effectively analyze large and complex datasets, uncovering hidden patterns and correlations that traditional methods might miss, ultimately resulting in more precise and reliable valuations.

Generative Adversarial Networks (GANs) for Synthetic Data

Generative Adversarial Networks (GANs) offer a novel approach to real estate valuation. Instead of relying solely on existing data, GANs can generate synthetic data points to augment the training dataset. This technique is particularly valuable when dealing with limited or incomplete datasets. GANs can create realistic synthetic data points that mirror the characteristics of real properties, helping to overcome data scarcity issues and enhancing the robustness and accuracy of valuation models. This process can lead to more reliable valuations, especially in niche markets or regions with limited historical data.

The creation of synthetic data through GANs allows for the modeling of various scenarios and potential market fluctuations. This expanded dataset, generated by GANs, can be used to train more robust and adaptable valuation models, enabling them to better handle uncertainty and predict property values under different market conditions. This approach can be particularly valuable in developing regions or during periods of rapid economic transformation.

Reinforcement Learning for Dynamic Valuation

Reinforcement learning (RL) offers a unique perspective for real estate valuation, focusing on dynamic adjustments based on market feedback. RL models can learn from the outcomes of past valuations, adjusting their strategies and parameters to optimize performance over time. This adaptive approach allows for continuous learning and refinement of valuation techniques, enabling the model to respond to evolving market conditions and emerging trends. The ability to adapt to changing market conditions enhances the long-term reliability and effectiveness of real estate valuation models.

Transfer Learning for Enhanced Efficiency

Transfer learning is a powerful technique for leveraging pre-trained models in real estate valuation. By leveraging existing models trained on large datasets, transfer learning can accelerate the training process for new models, reducing the need for extensive data collection and processing. This approach improves efficiency by incorporating knowledge gained from other domains or markets, which can be particularly valuable in regions with limited local data. Transfer learning can facilitate faster model development and deployment, enabling more timely and efficient real estate valuations.

Explainable AI (XAI) for Enhanced Transparency

Explainable AI (XAI) techniques are crucial for building trust and understanding in real estate valuation models. By providing insights into the factors driving valuation decisions, XAI methods can enhance transparency and accountability. This approach helps to reveal the reasoning behind the model's predictions, allowing stakeholders to understand how the valuation was derived. The development and use of XAI in real estate valuation helps to foster trust in the process and ensure the transparency of the valuation methodology, ultimately fostering greater confidence in the results.

The Impact on Efficiency and Accessibility

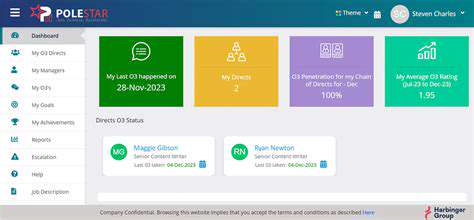

Streamlined Processes

Improved efficiency is a key benefit of adopting new technologies. Automation of repetitive tasks frees up valuable time for employees to focus on higher-level strategic initiatives. This often translates into a more streamlined workflow, reducing bottlenecks and improving overall productivity. The result is a significant boost in the speed and accuracy of completing projects.

Implementing new systems can also lead to more efficient processes by reducing manual interventions and providing real-time data access. This allows for quicker decision-making and problem-solving, ultimately resulting in a more agile and responsive organizational structure.

Enhanced Accessibility

New technologies often break down geographical barriers, enabling remote access to information and resources. This increased accessibility fosters collaboration among geographically dispersed teams and allows employees to work from anywhere with an internet connection. This flexibility boosts employee satisfaction and engagement.

Improved accessibility also extends to customers, who can access services and products 24/7. This round-the-clock availability significantly enhances customer satisfaction and expands market reach. The result can be a noticeable increase in sales and revenue.

Reduced Costs

Implementing new technologies can lead to substantial cost savings over time. Automation of tasks can reduce labor costs and eliminate errors, which in turn lowers operational expenses. Moreover, the use of data analytics can help identify areas for cost reduction and optimize resource allocation.

Software solutions often provide more efficient data management, reducing the need for extensive manual data entry and storage. These savings lead to a more cost-effective operation in the long run, impacting profitability positively.

Improved Decision-Making

Data-driven insights are crucial for informed decision-making. New technologies often provide access to real-time data and analytics, empowering managers and employees to make more informed and timely decisions. This data-driven approach can lead to better strategic planning, resource allocation, and overall business performance.

Access to comprehensive, accurate data enables a deeper understanding of market trends and customer behavior. This translates into more effective marketing strategies, targeted campaigns, and a better understanding of customer needs, resulting in a significant competitive advantage.

Increased Productivity

The integration of new technologies often leads to a noticeable increase in employee productivity. Streamlined workflows and automated tasks mean employees can dedicate more time to higher-value activities. This efficiency boost directly contributes to a more productive workforce.

Improved access to information and collaborative tools also enhances productivity by fostering teamwork and communication. This synergy leads to faster project completion and higher quality outputs.

Enhanced Customer Experience

New technologies often translate into a better customer experience. Real-time support, personalized recommendations, and convenient self-service options are just a few examples. These improvements enhance customer satisfaction, loyalty, and ultimately, profitability.

Modern technologies can significantly improve customer service by providing faster response times, more accurate information, and tailored solutions. This leads to higher customer satisfaction and positive brand reputation.

Scalability and Growth

Adaptable technologies are essential for supporting future business growth. The ability to scale operations and adapt to changing market demands is crucial for long-term success. New technologies can provide the flexibility and scalability needed to accommodate future growth.

Scalable technologies allow businesses to easily adapt to fluctuations in demand or market changes. This adaptability enables them to leverage opportunities for expansion and maintain a competitive edge in the dynamic market.

Read more about The Evolution of AI in Real Estate Valuation Models

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy