Real Estate Climate Risk Frameworks

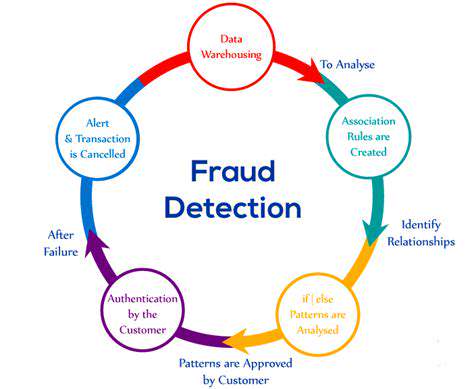

The insurance crisis exemplifies systemic risk - carriers now regularly exclude certain perils or withdraw from entire regions. This creates valuation gaps where traditional income approaches fail to account for uninsurable risks, potentially overvaluing assets by 15-30% in high-risk zones.

Assessing the Financial Implications of Climate Risk

Sophisticated investors now run climate stress tests, modeling scenarios from IPCC reports against asset cash flows. A single property might face:

- 23% higher maintenance costs from extreme heat degradation

- 40% insurance premium increases after major weather events

- 12-18 month business interruption from flood recovery

Discount rates are being recalibrated, with climate-vulnerable assets seeing cap rate expansions of 50-150 basis points compared to resilient properties. This repricing occurs fastest in institutional markets, creating arbitrage opportunities for investors with superior climate analytics.

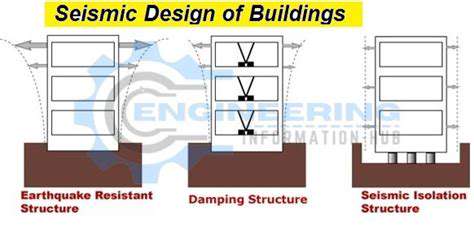

Developing Climate-Resilient Real Estate Strategies

Leading developers now treat resilience as a value driver rather than compliance cost. Miami's newest towers incorporate floodable ground floors with marine-grade materials, while Phoenix projects integrate radiant cooling in sidewalks. The most advanced projects achieve positive resilience - structures that actually improve during climate events, like flood walls that generate solar power or roofs that harvest stormwater for drought periods.

Retrofits follow similar logic: Chicago's Willis Tower spent $500 million on upgrades that reduced energy use 20% while adding hurricane-resistant glazing. Such investments now demonstrate clear ROI, with premium leasing rates for certified resilient space.

Integrating Climate Risk into Real Estate Valuation

Cutting-edge valuation models now weight climate factors equally with traditional metrics. Machine learning algorithms parse thousands of data points - from soil moisture trends to local adaptation budgets - generating probabilistic risk scores. These models reveal surprising insights, like how properties near fire stations maintain value better during wildfire seasons despite similar physical risks.

The Role of Policy and Regulation in Managing Climate Risk

The regulatory landscape evolves monthly: Boston now requires climate resilience audits for large properties, while California mandates disclosure of wildfire mitigation efforts. Savvy investors maintain policy watcher teams tracking 200+ jurisdictions simultaneously. The most advanced firms engage in climate shaping, working with municipalities to direct infrastructure investments that enhance their portfolio resilience.

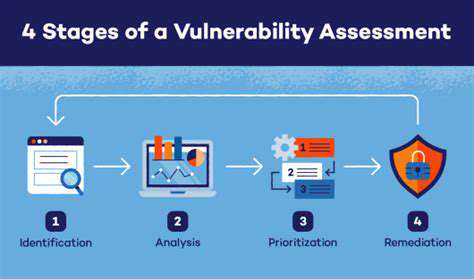

Developing Robust Climate Risk Assessment Frameworks

Understanding the Scope of Climate Risk Assessment

Modern assessments transcend simple flood zone checks. Comprehensive frameworks now evaluate:

1. Physical risks (acute and chronic)

2. Transition risks (policy, technology, market shifts)

3. Liability risks (disclosure requirements, litigation trends)

The most valuable assessments identify climate arbitrage opportunities - undervalued assets with mitigation potential, like older buildings near new flood control infrastructure. These often outperform obviously resilient properties trading at premium prices.

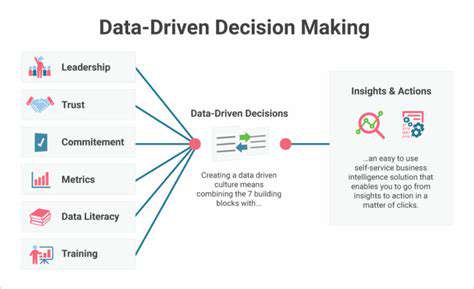

Strategies for Implementing Effective Climate Risk Assessments

Top-performing funds employ climate war rooms where meteorologists, engineers, and data scientists collaborate in real-time. Their process:

1. Ingest 15+ climate data streams (satellite, sensor networks, insurance claims)

2. Run ensemble modeling across multiple scenarios

3. Stress test portfolios against 20-year climate projections

The key innovation: translating climate science into financial impact statements that CFOs can act upon. Instead of saying increased flood risk, they project potential 7% NOI reduction from 2028 due to basement flooding.

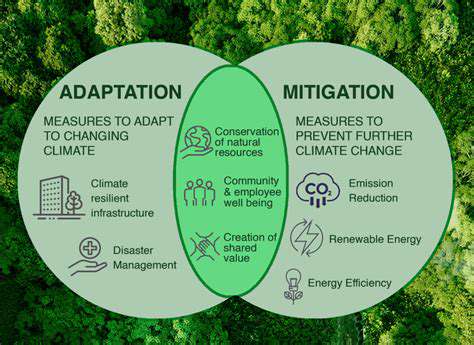

Strategies for Adapting and Mitigating Climate Risks

Understanding the Need for Adaptation

The smartest players treat adaptation as competitive advantage. A Manhattan REIT recently gained 300bps in total return by:

- Installing submarine-grade windows before hurricane season

- Pre-signing disaster recovery contractors

- Creating tenant resilience manuals

Their secret: viewing climate events as predictable operational challenges rather than black swans.

Investing in Climate-Resilient Infrastructure

Forward-thinking projects now incorporate:

- Wetproof electrical systems (function when submerged)

- Phase-change materials for temperature buffering

- Distributed energy microgrids with 14-day outage capacity

The ROI case has flipped - resilient features now command 8-12% rent premiums in most markets, with capitalization rates 50-75bps lower than conventional properties.

The Future of Real Estate Climate Risk Management

The Shifting Sands of Real Estate Investment

We're entering the era of climate alpha - where superior risk analysis generates outperformance. The new differentiator isn't avoiding risky properties, but accurately pricing risks others misjudge. This creates opportunities in:

- Climate migration hubs (cities benefiting from population shifts)

- Adaptation tech real estate (data centers for weather modeling, etc.)

- Cross-border climate arbitrage

The most valuable skill will be climate fluency - conversant in both IPCC reports and cap rate calculations.