Quantifying Climate Risk for Real Estate Portfolios

Identifying Potential Hazards

A crucial first step in assessing physical risks is to meticulously identify all potential hazards within a given environment. This involves a thorough inspection, considering both obvious and less apparent dangers. Failing to identify all potential hazards can lead to serious repercussions, and a comprehensive approach is essential. This includes considering the history of incidents and near misses, as well as consulting with relevant safety personnel and experts.

Thorough documentation of these hazards is vital for future reference and risk mitigation strategies. Detailed descriptions, including location, frequency, and potential severity, should be recorded.

Evaluating Hazard Severity

Once potential hazards are identified, the next step is to evaluate their severity. This requires a careful assessment of the potential for injury or damage, considering factors like the likelihood of occurrence and the potential impact. Determining the severity of a hazard is essential for prioritizing mitigation efforts. This involves considering the potential consequences of an incident, from minor injuries to serious accidents or even fatalities.

Analyzing Exposure Levels

Understanding the extent of exposure to identified hazards is critical for effective risk management. This involves determining who or what might be affected, how frequently they are exposed, and the duration of their exposure. Accurate exposure analysis helps in the development of targeted safety measures. For example, if a worker spends only brief periods near a hazardous substance, the mitigation strategy might differ from one where continuous exposure is a concern.

Establishing Probability of Occurrence

A critical element in risk assessment is estimating the likelihood of a hazard causing an incident. This involves considering historical data, frequency analysis, and the potential for external factors to influence the occurrence. This evaluation helps in setting realistic expectations about safety risks. A high-probability hazard requires immediate attention, while a low-probability hazard might still necessitate preventative measures depending on the severity of potential consequences.

Developing Mitigation Strategies

Once the hazards, their severity, and the exposure levels are understood, the focus shifts to developing effective mitigation strategies. This involves implementing safety protocols, providing appropriate personal protective equipment (PPE), and establishing emergency response plans. These strategies should be tailored to the specific hazards and risks identified.

Implementing and Monitoring Controls

Successfully managing physical risks demands a comprehensive approach to implementing and monitoring controls. This includes ensuring the proper use of safety equipment, adherence to safety procedures, and regular inspections to ensure the effectiveness of implemented controls. Regular monitoring is crucial to ensure the ongoing effectiveness of safety measures. This also involves adapting strategies to new developments, emerging risks, or changes in circumstances.

Communicating and Training

Effective communication and training are fundamental to successful risk management. Clear communication of identified risks, mitigation strategies, and emergency procedures is essential for all stakeholders. Well-trained personnel are better equipped to recognize and respond to potential hazards. Training should be ongoing and adapted to new situations or changes in procedures.

Evaluating Transition Risks: Beyond Physical Impacts

Understanding Transition Risks

Transition risks, in the context of climate change, refer to the financial and operational challenges businesses face as the world shifts away from fossil fuels and towards a low-carbon economy. These risks are not just about the physical impacts of climate change, like extreme weather events, but also the broader systemic changes required to meet climate goals. This shift necessitates significant changes in infrastructure, regulations, and consumer behavior, all of which can create substantial hurdles for companies reliant on traditional energy sources or unsustainable practices. Understanding these risks is crucial for proactive planning and mitigation strategies.

Identifying Key Transition Drivers

Several factors drive the transition to a low-carbon economy, making them crucial considerations for assessing transition risks. Policy changes, such as carbon pricing mechanisms, regulations on emissions, and incentives for renewable energy adoption, significantly impact businesses' profitability and long-term viability. Technological advancements in renewable energy sources, energy storage, and carbon capture technologies are also important drivers, often creating opportunities for innovation and new markets while simultaneously rendering certain existing technologies obsolete.

Consumer demand plays a critical role as well, with increasing awareness and preference for sustainable products and services influencing investment decisions and corporate strategies. These intertwining forces create a complex interplay of risks and opportunities that businesses must carefully navigate.

Assessing Sector-Specific Vulnerabilities

Transition risks are not uniform across all sectors. Industries heavily reliant on fossil fuels, such as oil and gas extraction, power generation, and transportation, face more significant and immediate risks. Changes in energy demand and supply chains, coupled with policy shifts, can dramatically impact their profitability and operations. Conversely, sectors like renewable energy and sustainable technologies are positioned to benefit from the transition, although they may face challenges in scaling up production and market penetration.

Evaluating Financial Implications

The financial implications of transition risks can be substantial. Changes in asset values, increased capital expenditure for retrofitting or transitioning to new technologies, and potential liabilities related to stranded assets are all key concerns. Companies need to evaluate the potential financial losses associated with a failure to adapt to the transition, and consider alternative investments that align with a low-carbon future.

Analyzing Operational Disruptions

Transition risks can lead to significant operational disruptions, affecting supply chains, production processes, and workforce skills. The shift to renewable energy sources may require substantial changes in infrastructure and manufacturing processes, potentially leading to operational inefficiencies and logistical challenges. Furthermore, a mismatch between workforce skills and the demands of a low-carbon economy could lead to labor shortages and higher training costs.

Developing Mitigation Strategies

Effective mitigation strategies are essential to manage transition risks. Companies should conduct thorough risk assessments, develop contingency plans, and explore opportunities for innovation and adaptation. This includes diversifying their product portfolio, investing in research and development, and building strong relationships with stakeholders. Proactive engagement with policymakers and industry associations is also crucial to influence regulations and create a more favorable transition environment.

Integrating Transition Risk into Investment Decisions

Transition risks should be integrated into investment decision-making processes. Investors need to consider the long-term implications of climate change and the transition to a low-carbon economy when evaluating potential investments. This includes assessing the resilience of companies to transition risks and identifying opportunities in emerging sectors. A holistic approach that considers both physical and transition risks is crucial for sustainable investment practices.

.top/Global-Soup-Recipes-with-a-Plant-Based-Twist>Asian cultures boast a rich and diverse history, spanning millennia, and encompassing a multitude of traditions, beliefs, and artistic expressions. From the ancient philosophies of China to the vibrant street markets of Southeast Asia, the region's influence on the world is undeniable. This rich tapestry is woven from threads of intricate craftsmanship, spiritual depth, and a profound connection to nature. Understanding these influences provides a deeper appreciation for the global community.

Integrating Climate Risk into Portfolio Valuation and Decision Making

Understanding the Port Ecosystem

Ports are complex ecosystems, intricately interwoven with surrounding communities, industries, and supply chains. Understanding the intricate relationships within this ecosystem is crucial for effective climate risk integration. This involves identifying key vulnerabilities, such as infrastructure weaknesses, and assessing the potential impacts of climate change on critical port operations.

A comprehensive understanding of the port's dependencies and interdependencies is paramount. This includes analyzing the flow of goods and services, the reliance on specific transportation modes, and the potential for cascading effects from disruptions in one area to other parts of the port and beyond.

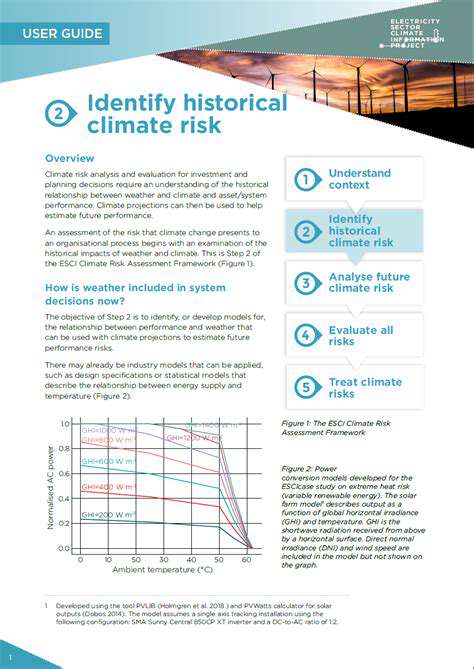

Assessing Climate Change Impacts

Climate change presents a multitude of potential risks to ports, including rising sea levels, increased storm intensity, changes in precipitation patterns, and more frequent and intense heat waves. These risks can lead to significant disruptions in port operations, impacting cargo handling, vessel movement, and overall efficiency.

Evaluating the specific vulnerabilities of port infrastructure is essential, considering factors such as the elevation of facilities, the resilience of docks and wharves, and the capacity of drainage systems to handle increased rainfall. These assessments should be conducted with a focus on long-term projections to anticipate future impacts.

Developing Adaption Strategies

Adapting to climate change requires proactive measures to enhance the resilience of port operations. This might involve upgrading infrastructure, implementing early warning systems for extreme weather events, and developing contingency plans for disruptions. Investing in robust infrastructure upgrades is critical to ensure long-term sustainability, particularly for facilities facing a high risk of flooding or erosion.

Implementing innovative technologies and procedures can significantly enhance the port's ability to withstand climate-related events. This could include employing advanced weather forecasting models, implementing real-time monitoring systems for critical infrastructure, and exploring alternative transportation and logistics solutions.

Integrating Climate Considerations into Planning

Integrating climate risk into port planning should involve a holistic approach that considers the entire lifecycle of port activities. This necessitates incorporating climate projections into long-term strategic plans, from infrastructure development to operational procedures. Port authorities need to proactively consider the potential impacts of climate change in all phases of planning and decision-making.

This should also include stakeholder engagement, ensuring that all relevant parties, including businesses, communities, and government agencies, are involved in the planning process. This collaborative approach is essential for developing effective solutions and ensuring the long-term sustainability of port operations.

Financial and Economic Implications

The financial implications of climate change on ports are substantial. Costs associated with infrastructure upgrades, contingency planning, and potential disruptions to operations can be significant. Understanding these costs and incorporating them into investment decisions is crucial for long-term sustainability.

Furthermore, the economic impacts extend beyond the port itself. Disruptions to port operations can ripple through global supply chains, affecting businesses, communities, and economies worldwide. Careful consideration of these wider economic impacts is necessary for informed decision-making and effective risk management.

Read more about Quantifying Climate Risk for Real Estate Portfolios

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy