Blended Finance for Sustainable Real Estate

The Future of Blended Finance in Sustainable Real Estate

The Rise of Impact Investing

Blended finance is increasingly intertwined with the concept of impact investing, which seeks to generate financial returns while simultaneously achieving positive social and environmental outcomes. This convergence is driving innovation in the design and implementation of blended finance mechanisms. Investors are recognizing the potential for significant returns alongside positive societal impact. This shift reflects a growing awareness of the interconnectedness of financial gain and global challenges.

Impact investing strategies are increasingly incorporating blended finance principles, leveraging public and private capital to address pressing global issues. This approach is proving to be a powerful catalyst for sustainable development and economic growth. The integration of environmental, social, and governance (ESG) factors into investment decisions is further bolstering the impact investing landscape.

Technological Advancements

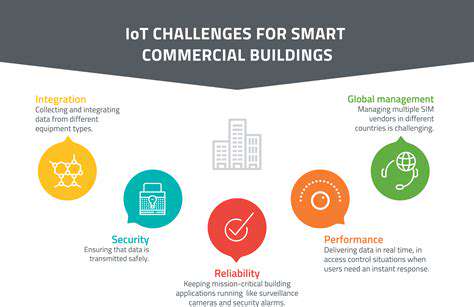

Technological advancements are revolutionizing the way blended finance operates. Digital platforms are facilitating the efficient matching of capital flows, thereby reducing transaction costs and increasing transparency in the process. Blockchain technology has the potential to enhance the security and traceability of blended finance transactions, particularly for projects in developing countries.

The use of data analytics allows for better risk assessment and project evaluation, enabling investors to identify and prioritize projects with the highest potential for impact. These innovations are critical for scaling blended finance initiatives and ensuring their long-term sustainability.

The Role of Public-Private Partnerships

Public-private partnerships (PPPs) are becoming increasingly important in the context of blended finance. These collaborations allow governments to leverage private sector expertise and capital to achieve their development goals. This approach can unlock significant resources and accelerate the implementation of projects with significant social and environmental impact.

PPPs can also help to address the challenges associated with project implementation, such as regulatory hurdles and local capacity building. Effective partnerships require a clear framework for accountability, transparency, and risk sharing, fostering trust and cooperation.

Addressing Financial Inclusion

A crucial aspect of the future of blended finance is its role in promoting financial inclusion. Blended finance mechanisms can be leveraged to provide access to financial services for marginalized communities, enabling them to participate in the formal economy and improve their livelihoods. This focus on inclusion is essential for creating a more equitable and sustainable future for all.

By providing access to microloans, savings accounts, and other financial products, blended finance can empower individuals and communities to build assets, invest in their future, and contribute to economic growth. This is particularly important in developing countries where traditional financial institutions may not be readily accessible.

Sustainable Infrastructure Development

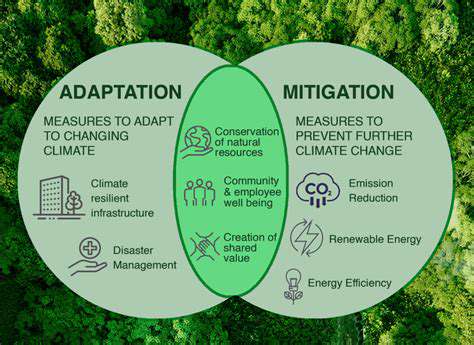

Blended finance plays a crucial role in financing sustainable infrastructure projects. These projects often require significant upfront capital and long-term commitments, making them attractive targets for blended finance mechanisms. Sustainable infrastructure projects, including renewable energy, efficient transportation, and resilient water management systems, are crucial for mitigating climate change and promoting sustainable development.

The integration of environmental, social, and governance (ESG) factors into infrastructure projects is becoming increasingly important. This is driven by a growing recognition of the long-term benefits of sustainable infrastructure, including cost savings, reduced environmental impact, and enhanced social equity.

Read more about Blended Finance for Sustainable Real Estate

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

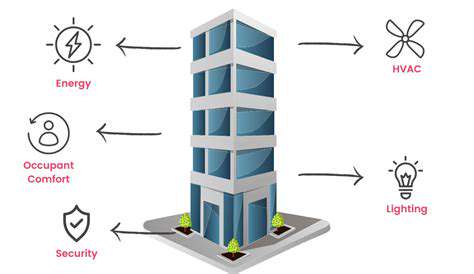

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy