AI Driven Valuation: Unlocking Hidden Opportunities in Real Estate

Predictive Modeling: Anticipating Market Shifts

Understanding the Fundamentals of Predictive Modeling

Predictive modeling, a cornerstone of AI-driven valuation, leverages historical data and statistical algorithms to forecast future market trends. By identifying patterns and relationships within data, predictive models can anticipate potential shifts in supply, demand, and consumer behavior. This understanding is crucial for businesses seeking to adapt to dynamic market conditions and make informed investment decisions.

Essentially, predictive modeling acts as a crystal ball, peering into the future to gauge market responses to various strategies and scenarios. This foresight allows companies to preemptively adjust strategies, allocate resources more effectively, and optimize their operations for maximum profitability.

Data Preparation and Feature Engineering

A critical aspect of predictive modeling is the meticulous preparation and refinement of the data used. Raw data often contains inconsistencies, missing values, and irrelevant information. Data cleaning and feature engineering techniques are employed to transform raw data into a usable format. This process involves identifying, cleaning, and transforming relevant variables, which are then used to train and validate the predictive model.

Model Selection and Training

Choosing the appropriate predictive model is paramount to achieving accurate forecasts. The selection depends on the nature of the data and the specific research questions. Popular models include regression analysis, time series analysis, and machine learning algorithms like support vector machines and neural networks. Model training involves feeding the prepared data into the chosen model to identify patterns and relationships.

Different models have varying strengths and weaknesses. The choice of model is crucial for accuracy and reliability, and it should be aligned with the specific business objectives of the valuation process.

Model Validation and Evaluation

Model validation is essential to ensure the accuracy and reliability of the forecasts. This involves evaluating the model's performance using independent data sets that were not used during training. Various metrics, such as accuracy, precision, recall, and F1-score, are employed to assess the model's predictive power and identify potential biases.

Applications of Predictive Modeling in Market Valuation

Predictive modeling holds immense potential in various aspects of market valuation, enabling companies to anticipate and react to potential shifts in the market. It can be applied to price forecasting, risk assessment, and investment strategy development.

For instance, predictive models can be used to anticipate the impact of new regulations on market trends, allowing companies to adjust their strategies and mitigate potential losses. This proactive approach is vital for long-term success in dynamic market environments.

Interpreting and Communicating Model Results

The results of predictive modeling need to be clearly interpreted and communicated to stakeholders. Visualizations and clear explanations can facilitate a better understanding of the model's insights and their implications for future market behavior.

The ability to effectively translate complex data analysis into actionable insights is crucial for successful implementation of predictive models within the context of AI-driven valuation. Transparency and clarity in communication are essential for building trust and promoting informed decision-making.

Ethical Considerations and Bias Mitigation

As predictive modeling relies heavily on data, it's essential to address potential biases inherent in the datasets used. Bias in the data can lead to inaccurate or unfair predictions. Careful consideration of data sources, potential biases, and the implications of model outputs is critical for ethical application of AI-driven valuations.

Developing models that are fair and unbiased is crucial to ensure that AI-driven valuations contribute to a just and equitable market environment. Recognizing and mitigating biases in data and algorithms is an ongoing effort that requires careful attention from practitioners and policymakers.

Data-Driven Insights: Unveiling Hidden Value

Understanding the Power of Data

Data-driven insights are crucial in today's world, especially in the realm of AI-driven valuation. Large datasets, when analyzed effectively, can reveal patterns and correlations that would be impossible to discern through traditional methods. This analysis can lead to a deeper understanding of market trends, competitor strategies, and overall economic landscapes, all of which are critical in accurately assessing the value of assets, companies, or investments.

The sheer volume of data available today presents a significant opportunity for uncovering hidden value. However, this potential is only realized through sophisticated analytical techniques and the ability to interpret the data accurately. This often involves employing algorithms and machine learning models to identify complex relationships and extract meaningful information from seemingly disparate sources.

Identifying Key Performance Indicators (KPIs)

Identifying the right Key Performance Indicators (KPIs) is paramount to a successful data-driven valuation. These indicators should directly reflect the core drivers of value for the specific asset or business being evaluated. For example, in analyzing a social media company, KPIs might include daily active users, engagement rates, and user growth, all of which directly impact the company's potential revenue and market capitalization.

Choosing relevant KPIs requires a deep understanding of the industry, the specific business model, and the competitive landscape. Blindly applying generic KPIs can lead to inaccurate and misleading valuation results. Therefore, careful selection and contextualization are essential for extracting meaningful insights.

Leveraging Machine Learning Techniques

Machine learning algorithms are transforming the way we analyze data and extract insights. These algorithms can identify complex patterns and relationships in vast datasets, revealing hidden correlations that traditional methods might miss. For instance, machine learning can predict future market trends based on historical data, enabling more accurate and forward-looking valuation models.

Specific machine learning techniques, such as regression analysis, clustering, and classification, can be employed to model different aspects of business performance and market behavior. This leads to more sophisticated and nuanced valuations that incorporate a wider range of factors influencing the asset's value.

Analyzing Market Trends and Competitor Strategies

Understanding market trends and competitor strategies is crucial for accurate valuation. Data analysis can reveal shifts in consumer preferences, emerging technologies, and regulatory changes that impact the market dynamics. This analysis also includes assessing the strategies of competitors, allowing for better positioning and risk assessment for the subject of valuation.

Thorough analysis of competitor data can provide valuable insights into pricing strategies, market share, and overall business performance. This knowledge is essential for determining a realistic and competitive valuation, considering the relative strengths and weaknesses of the various players in the market.

Predictive Modeling for Future Value Projections

One of the most powerful applications of data-driven insights is predictive modeling. By analyzing historical data and current trends, AI-powered models can forecast future performance, allowing for more accurate projections of the subject's future value. This predictive capability is vital in making informed investment decisions.

Predictive models can consider a variety of factors, such as economic indicators, industry trends, and company performance, to generate more comprehensive and nuanced projections of future value. The accuracy of these predictions depends on the quality and relevance of the data used and the sophistication of the predictive models themselves.

The Importance of Data Quality and Interpretation

Ultimately, the success of data-driven insights hinges on the quality and integrity of the data itself. Inaccurate or incomplete data can lead to misleading conclusions and inaccurate valuations. Therefore, rigorous data validation and cleansing procedures are essential to ensure that the analysis is based on reliable information.

Beyond the data itself, skilled interpretation is crucial. Simply producing a large volume of data is insufficient; the ability to extract meaningful insights and translate them into actionable strategies is equally important for effective AI-driven valuation. This requires specialized expertise in data analysis and a deep understanding of the business context.

Gene editing, a revolutionary field, involves altering an organism's DNA. This precise modification of genetic material holds immense potential for treating a wide range of diseases, including cancer. The ability to target and modify specific genes within cells opens doors to therapies that were previously unimaginable. Techniques like CRISPR-Cas9 are at the forefront of this exciting advancement, offering a powerful tool for researchers and clinicians.

The Future of Real Estate Investment: Leveraging AI for Enhanced Returns

The Rise of Technology in Real Estate Investment

Technological advancements are rapidly transforming the real estate landscape, offering investors new tools and opportunities. From sophisticated data analytics platforms to AI-powered property valuation models, technology streamlines investment processes and provides more accurate market insights. This technological shift is crucial for investors to navigate the complexities of the market and capitalize on emerging trends.

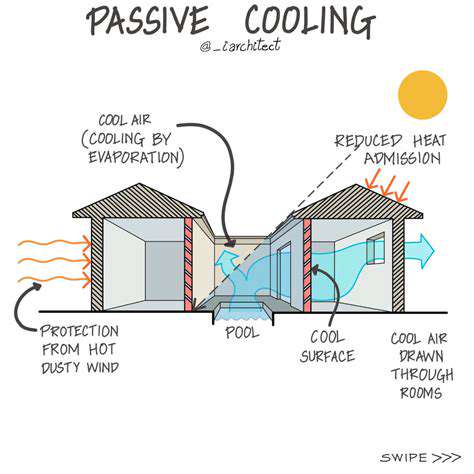

Sustainable Practices and ESG Factors

Environmental, social, and governance (ESG) factors are increasingly influencing real estate investment decisions. Investors are seeking properties that align with sustainable practices and demonstrate a commitment to environmental responsibility. This includes buildings with high energy efficiency ratings, renewable energy sources, and eco-friendly construction materials, signifying a growing importance of sustainability in real estate investment strategies.

The Impact of Global Economic Trends

Global economic fluctuations significantly affect real estate markets. Factors such as interest rate changes, inflation, and geopolitical events influence investor confidence and property values. Understanding and anticipating these global trends is critical for successful real estate investments and mitigating potential risks. Investors need to stay informed and adapt their strategies to navigate these economic shifts.

Real Estate Investment Trusts (REITs) and Their Evolution

Real Estate Investment Trusts (REITs) remain a prominent vehicle for real estate investment. The evolution of REITs reflects a dynamic market, with diversification into various property types and geographical locations. REITs provide a way for investors to gain exposure to the real estate sector without the complexities of direct ownership. This indirect investment approach allows for potential diversification and access to professional management.

The Importance of Data-Driven Decision Making

Real estate investment decisions are becoming increasingly data-driven. Investors rely on market analysis, property valuations, and financial modeling to make informed choices. Data analytics provides valuable insights into market trends, property performance, and potential risks. This data-driven approach allows for more accurate predictions and optimized investment strategies.

The Role of Alternative Financing Methods

Traditional financing methods are evolving, and alternative financing options are gaining traction in the real estate market. This includes crowdfunding platforms, private equity investments, and venture capital for real estate startups. These alternative financing methods provide access to capital for a wider range of investors and projects. The accessibility of these methods could potentially accelerate development and innovation in the industry.

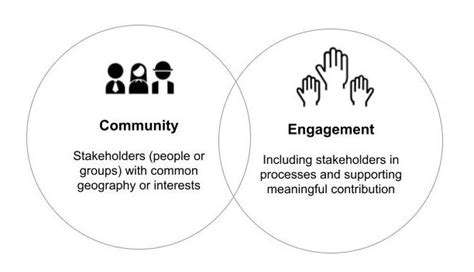

The Future of Real Estate: A Collaborative Approach

The future of real estate investment likely involves a collaborative approach, combining the expertise of investors, developers, and technology providers. This synergy fosters innovation and efficiency throughout the entire investment lifecycle. From project conception to completion, collaboration is essential for navigating the complexities of the market and maximizing returns.

Read more about AI Driven Valuation: Unlocking Hidden Opportunities in Real Estate

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy