Sustainable Real Estate: Investing in a Healthier Planet and a More Prosperous Future

The Financial Advantages of Sustainable Real Estate Investments

Reduced Operating Costs

Implementing sustainable practices often leads to significant cost savings in the long run. For example, energy-efficient equipment and processes can drastically reduce utility bills. This reduction in operational expenses translates directly into higher profit margins and improved overall financial performance. Sustainable waste management strategies, including recycling and reuse programs, can minimize disposal costs and free up capital for other investments.

Efficient water usage, another crucial aspect of sustainability, can lower water bills and reduce the need for costly infrastructure upgrades. These cost savings are compounded over time, leading to substantial financial benefits for the organization.

Enhanced Brand Reputation and Customer Loyalty

Consumers are increasingly aware of environmental issues and are actively seeking out companies that demonstrate a commitment to sustainability. A strong sustainability record can significantly enhance a company's brand image and attract environmentally conscious customers. This positive brand perception can translate into increased sales and customer loyalty.

Demonstrating a commitment to sustainability can also attract investors and employees who value ethical and responsible business practices. This positive reputation can be a powerful tool for attracting top talent and securing further investment opportunities.

Access to Green Financing and Incentives

Financial institutions and governments are increasingly offering green financing options and incentives to businesses that adopt sustainable practices. These opportunities can provide access to lower-cost capital for sustainable projects and initiatives. Leveraging these financial incentives can significantly reduce the financial burden of implementing sustainable practices and accelerate the transition to a more sustainable business model.

Furthermore, green bonds and other sustainable financing instruments can provide access to capital specifically dedicated to environmentally friendly projects. This targeted funding can accelerate the adoption of sustainable technologies and practices.

Improved Supply Chain Efficiency

Sustainable practices often improve supply chain efficiency. By optimizing resource utilization and reducing waste, companies can minimize transportation costs and improve logistics. This enhanced efficiency translates into cost savings and reduced environmental impact throughout the supply chain.

Sustainable sourcing practices can also strengthen relationships with suppliers who share similar values. This collaboration can improve the overall reliability and resilience of the supply chain, ultimately contributing to better financial performance.

Long-Term Value Creation

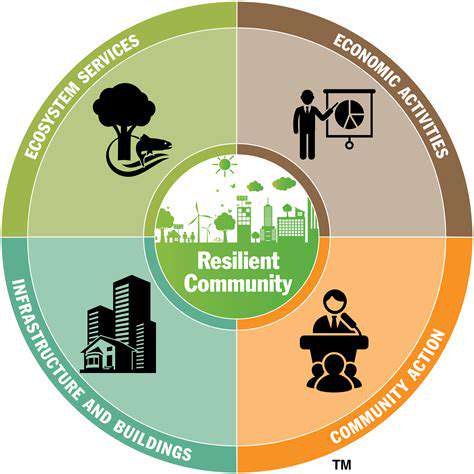

Investing in sustainability is not just about short-term cost savings; it's about creating long-term value for the business and society as a whole. Sustainable practices often lead to increased resilience in the face of environmental challenges and market fluctuations. This resilience translates into a more stable and predictable financial future for the company.

By integrating sustainability into core business strategies, companies can build a more robust and sustainable future, leading to long-term financial prosperity and positive social impact.

The Future of Real Estate: A Sustainable Trajectory

The Rise of Sustainable Design

Sustainable design principles are increasingly influencing real estate development, from the materials used in construction to the energy efficiency of buildings. Developers are recognizing the long-term benefits of incorporating eco-friendly practices, including reduced environmental impact and enhanced property value. This shift towards sustainability is not just a trend; it's a critical response to the growing global awareness of climate change and the need for responsible resource management within the built environment.

Technological Advancements in Real Estate

Technology is rapidly transforming the real estate industry. From virtual tours and 3D modeling to AI-powered property valuations and smart home systems, technology is streamlining processes, enhancing efficiency, and creating new opportunities for both buyers and sellers. This integration of technology is revolutionizing how we experience, buy, and manage real estate, offering unprecedented convenience and insights.

The use of drones for property inspections and virtual reality for immersive property tours are just a couple of examples of how technology is changing the real estate industry.

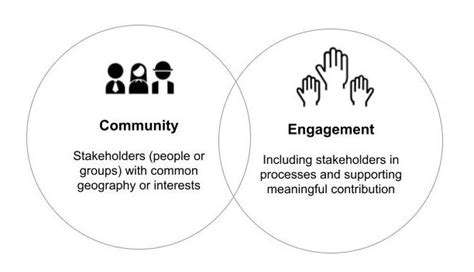

The Impact of Urbanization and Demographics

Urbanization continues to reshape real estate markets, driving demand for high-density, mixed-use developments and specialized housing options. Demographic shifts, including an aging population and changing family structures, are also influencing the types of properties in high demand. Understanding these trends is crucial for developers and investors to anticipate future needs and adapt their strategies accordingly. This understanding of urban trends and demographic shifts is vital for successful real estate investment.

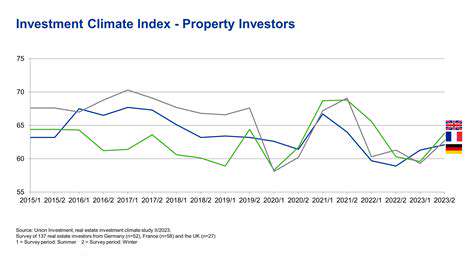

Financing and Investment Strategies

The availability of financing and investment strategies plays a critical role in shaping the future of real estate. Innovative financing options, such as green loans and sustainable investment funds, are emerging, attracting investors who prioritize environmentally conscious projects. Moreover, investors are increasingly seeking properties with strong long-term value potential, and sustainability is becoming a key factor in this evaluation. This shift in financing priorities is paving the way for environmentally friendly real estate development.

The Growing Importance of Accessibility and Inclusivity

Accessibility and inclusivity are becoming increasingly important considerations in real estate development. Developers are recognizing the need for properties that cater to diverse needs, including those of people with disabilities and those with varying mobility requirements. This focus on inclusivity extends to the design of public spaces and amenities, fostering a more equitable and welcoming environment for all residents. This growing emphasis on accessibility and inclusivity ensures the real estate sector embraces diversity and creates a more equitable environment for all residents.

Regulation and Policy Changes

Government regulations and policies will significantly influence the future of real estate. Changes in zoning laws, environmental regulations, and building codes are shaping the development landscape and encouraging the construction of more sustainable and resilient properties. These regulatory changes are not just about compliance; they're about creating a more sustainable and resilient future for the built environment. Understanding and adapting to these changes is crucial for developers and stakeholders alike.

Read more about Sustainable Real Estate: Investing in a Healthier Planet and a More Prosperous Future

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy