Extreme Weather Events: Real Estate Preparedness

Insurance and Risk Management Strategies

Understanding Insurance Coverage Gaps

Insurance policies provide critical protection, but they often fall short during extreme weather events. Homeowners must scrutinize policy exclusions—especially regarding flood damage, which frequently requires separate coverage. Deductibles also play a key role; these out-of-pocket expenses can catch property owners unprepared. Spotting these coverage weaknesses early enables smarter financial planning and reduces vulnerability to losses.

Standard homeowners' policies rarely cover catastrophic events like hurricanes or wildfires adequately, particularly in high-risk areas. A meticulous policy review helps identify these shortcomings. Purchasing supplemental insurance for specific hazards bridges these gaps, preventing financial shocks when disasters strike.

Developing a Risk Assessment Plan

Effective risk management starts with a thorough evaluation of property vulnerabilities. Location-specific factors—such as floodplains, wind patterns, or wildfire history—demand careful analysis. Examining decades of local weather data and construction standards reveals hidden risks. Properties near water or in wind corridors need tailored assessments to address their unique exposure.

Historical disaster patterns offer invaluable insights. Communities with frequent flooding may require elevated foundations, while tornado-prone regions benefit from reinforced structures. This proactive approach transforms raw data into actionable protection strategies.

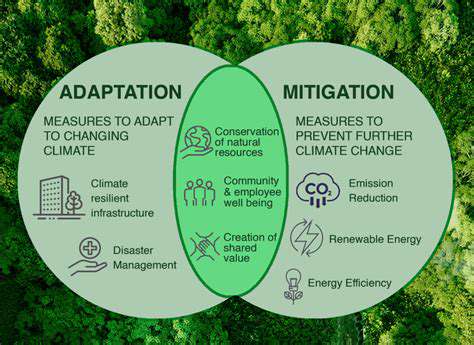

Implementing Mitigation Strategies

Physical upgrades significantly reduce weather-related damage. Impact-resistant roofing materials withstand hailstorms, while flood-resistant construction techniques minimize water intrusion. Strategic landscaping—like graded slopes and drought-resistant plants—combats both flooding and wildfires. These investments often yield long-term savings by preventing costly repairs.

Routine inspections maintain these protections. Annual roof checks, drainage system evaluations, and structural assessments catch minor issues before they escalate. Consistent maintenance preserves property value and prevents small problems from becoming financial disasters.

Financial Planning for Unexpected Costs

Weather emergencies create financial strain beyond insurance claims. A robust contingency fund covers deductibles, temporary housing, and lost income during rebuilding. Budgeting should account for worst-case scenarios—like multi-month displacements or business interruptions. Liquid assets ensure quick recovery without resorting to high-interest loans.

Insurance claim processes often move slowly after major disasters. Immediate access to emergency funds provides crucial breathing room during chaotic periods. This financial cushion reduces stress and enables faster property restoration.

Long-Term Planning for Real Estate Resilience

Understanding Your Financial Goals

Clear objectives guide successful real estate strategies. Investors must distinguish between seeking rental income versus property appreciation. This fundamental distinction shapes every subsequent decision—from property selection to financing methods. Current financial health analysis (income streams, existing debts, tax implications) creates realistic benchmarks.

Future lifestyle considerations matter equally. Expanding families may prioritize space over location, while empty nesters might favor low-maintenance properties. Anticipating these needs prevents costly mid-strategy adjustments.

Analyzing Market Trends and Opportunities

Successful investors monitor macroeconomic indicators and hyperlocal developments simultaneously. Interest rate fluctuations affect financing costs, while neighborhood-specific factors—like new schools or transit lines—impact values disproportionately. Demographic shifts (aging populations, remote work trends) create emerging opportunities in unexpected markets.

Micro-markets often outperform regional averages. Areas near university expansions or medical hubs frequently show resilience during economic downturns. This granular analysis identifies undervalued assets with strong growth potential.

Developing a Realistic Budget

Comprehensive budgets account for visible and hidden costs. Beyond mortgage payments, wise investors factor in vacancy rates, capital expenditures (roof replacements, HVAC systems), and fluctuating property taxes. This 360-degree financial view prevents cash flow surprises that derail long-term plans.

Seasonal variations also impact budgets—snow removal costs in winter, landscaping in summer. Accounting for these cyclical expenses creates more accurate financial projections.

Exploring Different Investment Strategies

Portfolio diversification mitigates risk. Some investors balance stable, low-yield rentals with value-add opportunities needing renovation. Others mix residential and commercial properties to capitalize on different market cycles. Each approach requires distinct skillsets and risk tolerance levels.

Emerging strategies like short-term rentals or co-living spaces offer alternatives to traditional models. These require deeper regulatory knowledge but can generate superior returns in certain markets.

Identifying Potential Risks and Mitigation Strategies

Seasoned investors develop contingency plans for multiple scenarios. Economic downturns may necessitate holding periods, while zoning changes could force strategy pivots. The most resilient portfolios anticipate black swan events—like pandemics or climate disasters—that traditional models ignore.

Insurance represents just one risk management tool. Legal structures (LLCs, trusts) and strategic partnerships provide additional protection layers against unforeseen liabilities.

Securing Financing and Legal Guidance

Creative financing separates amateur investors from professionals. Portfolio loans, private money lenders, and seller financing open doors when traditional mortgages falter. Building relationships with niche lenders before needing capital creates competitive advantages.

Legal counsel shouldn't be an afterthought. Specialized real estate attorneys navigate complex zoning issues, tenant disputes, and contract nuances that generic lawyers might miss. Their expertise prevents costly legal missteps.

Maximizing Property Value Through Preparedness

Understanding Market Trends

Local market intelligence separates profitable deals from money pits. Beyond standard metrics, successful investors track migration patterns, corporate relocations, and cultural shifts. Properties near emerging tech hubs or lifestyle amenities (trails, arts districts) often appreciate unexpectedly.

Infrastructure projects create hidden opportunities. New highways, sewer expansions, or broadband upgrades can transform marginal areas into desirable neighborhoods years before mainstream buyers notice.

Strategic Property Improvements

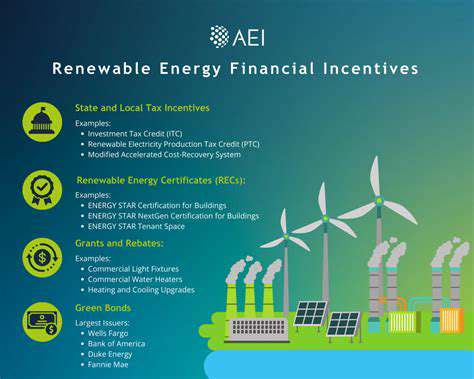

Value-add renovations require surgical precision. In luxury markets, high-end finishes justify premium pricing, while workforce housing benefits from durability over aesthetics. Energy-efficient upgrades (solar panels, smart thermostats) appeal to specific buyer demographics and often qualify for tax incentives.

Curb appeal investments yield disproportionate returns. Fresh paint, professional landscaping, and updated lighting create powerful first impressions that accelerate sales and increase offers.

Optimizing Marketing Strategies

Digital storytelling outperforms traditional listings. Drone footage showcases property context, while 3D tours accommodate remote buyers. Targeted social media ads reach precise demographics—young families respond differently than retirees. Multi-channel campaigns that highlight unique features (historic details, smart home tech) command premium prices.

Seasonal timing affects marketing effectiveness. Listing during peak moving seasons (spring/summer) maximizes exposure, while off-season sales may face less competition.

Financial Planning and Due Diligence

Sophisticated investors model multiple exit strategies. Some properties suit long-term holds, while others work better as quick flips. Accurate repair estimates prevent budget overruns—unforeseen structural issues can erase profits if not identified early.

Pre-purchase inspections should extend beyond standard checklists. Environmental assessments (radon, mold) and specialized evaluations (septic systems, foundations) uncover deal-breaking issues before closing. This rigorous approach prevents expensive surprises post-purchase.

Read more about Extreme Weather Events: Real Estate Preparedness

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy