Climate Risk and Real Estate Returns: Understanding the Correlation

Adapting to Climate Change: Opportunities in Resilient Properties

Understanding the Urgency of Climate Change Impacts

Climate change is no longer a distant threat; its impacts are being felt globally, from rising sea levels and more frequent extreme weather events to shifts in agricultural yields and disruptions to ecosystems. Understanding the severity and immediacy of these changes is crucial to developing effective strategies for adaptation and mitigation. The urgency of the situation demands immediate action to bolster infrastructure and build resilience into our built environment.

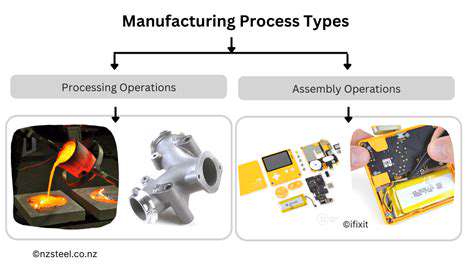

Investing in Sustainable Construction Practices

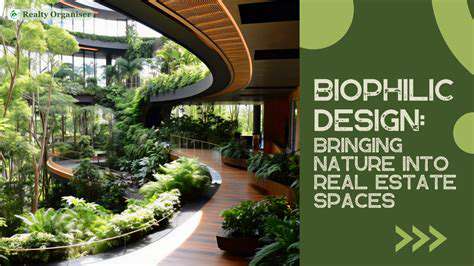

Sustainable construction techniques are not just environmentally friendly; they also offer significant long-term cost savings. Integrating principles like passive solar design, using recycled materials, and prioritizing energy-efficient systems can reduce operating costs and minimize environmental impact. Furthermore, the use of green building materials and practices contributes significantly to a healthier indoor environment for occupants.

These sustainable practices also reduce the carbon footprint of buildings, aligning with global efforts to mitigate climate change. Choosing sustainable materials and methods is an investment in the future, generating long-term value.

Designing for Enhanced Resilience to Extreme Weather

Adapting to climate change requires proactive design strategies. Building codes and design guidelines must be updated to incorporate the increasing frequency and intensity of extreme weather events. This includes incorporating features like elevated foundations, reinforced structures, and storm-resistant windows and doors. The goal is to build properties that can withstand flooding, high winds, and other climate-related hazards.

Developing Water Management Strategies

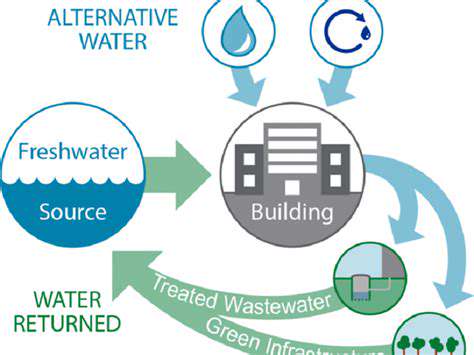

Water scarcity and flooding are major climate change concerns. Developing effective water management strategies for buildings is essential. This includes implementing water-efficient fixtures, rainwater harvesting systems, and greywater recycling. Smart irrigation systems and drought-resistant landscaping can further minimize water consumption and mitigate the effects of water scarcity.

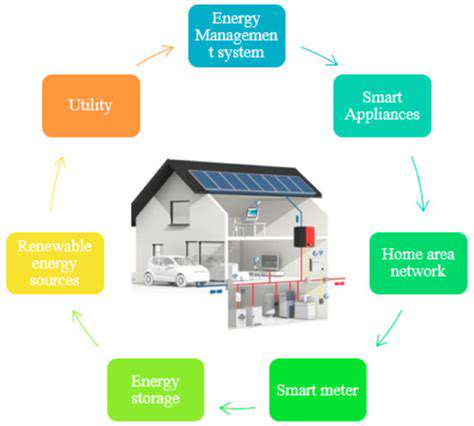

Enhancing Energy Efficiency and Renewable Energy Integration

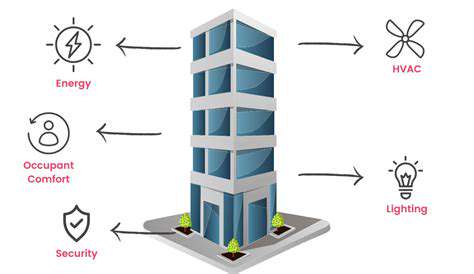

Reducing energy consumption and embracing renewable energy sources are crucial components of climate resilience. Integrating energy-efficient appliances, smart building technologies, and renewable energy systems like solar panels can significantly reduce a building's carbon footprint. By optimizing energy performance, buildings can contribute to the transition to a low-carbon economy and enhance their long-term sustainability.

Promoting Public-Private Partnerships for Climate Action

Addressing the challenges of climate change requires collaboration between the public and private sectors. Public-private partnerships can facilitate the development of innovative solutions and technologies for resilient properties. These partnerships can also support the adoption of sustainable practices and drive investment in climate-resilient infrastructure. This collaboration is essential to ensuring effective and widespread implementation of adaptation measures.

The Future of Real Estate Investment in a Changing Climate

Understanding Climate Change Impacts on Real Estate

The increasing frequency and severity of extreme weather events, rising sea levels, and shifting climate patterns are profoundly impacting the real estate market. Understanding these impacts is crucial for investors, developers, and policymakers alike. Prolonged periods of drought can render once-productive farmland useless, while intense rainfall events can lead to devastating flooding, damaging infrastructure and property values. These changes necessitate a proactive approach to risk assessment and mitigation strategies within the real estate sector.

Climate change is not just a distant threat; its effects are already being felt across various regions. Coastal communities face the escalating risk of erosion and inundation, while inland areas contend with more frequent and intense heat waves and wildfires. These challenges directly influence property values, investment attractiveness, and the long-term viability of real estate assets.

Adapting Investment Strategies to Climate Resilience

To navigate the evolving climate landscape, real estate investors need to adapt their strategies to prioritize climate resilience. This involves incorporating climate risk assessments into the due diligence process, evaluating the vulnerability of properties to climate-related hazards, and exploring opportunities for sustainable development and green building practices. Identifying and mitigating these risks is critical to ensuring the long-term profitability and sustainability of real estate investments.

Diversifying portfolios across different geographic locations, considering climate-proofed construction materials, and integrating renewable energy solutions are important steps in building climate resilience. Understanding the potential for future climate impacts is crucial for making informed decisions, and proactive investments in sustainable practices can significantly enhance long-term value.

Evaluating Climate-Related Financial Risks

Climate change presents significant financial risks for real estate investors. Property values in vulnerable areas can decline rapidly due to damage or regulatory restrictions, while insurance costs can escalate dramatically. The potential for physical damage from extreme weather events, as well as the cost of adaptation and mitigation measures, must be factored into investment decisions. Accurate risk assessments are needed to evaluate the financial implications of climate change and ensure sustainable investment strategies.

Beyond direct physical risks, real estate investors need to consider the regulatory and legal implications of climate change. Government policies and regulations regarding carbon emissions, building codes, and climate-related disclosures can affect property values and investment returns. Proactive engagement with regulatory changes and a long-term vision are paramount to navigating the shifting landscape.

Opportunities for Sustainable and Climate-Smart Development

Amidst the challenges, climate change presents significant opportunities for sustainable and climate-smart development. The demand for green buildings, energy-efficient technologies, and environmentally friendly construction practices is growing, creating new avenues for investment. Investing in renewable energy infrastructure, such as solar panels and wind turbines, can yield both environmental benefits and potentially attractive financial returns. Developers and investors who embrace these opportunities can position themselves as leaders in the transition to a more sustainable real estate market.

The transition to a low-carbon economy offers significant opportunities for growth and innovation in the real estate sector. Investments in green infrastructure, sustainable building technologies, and climate-resilient design can unlock significant returns while contributing to a more sustainable future. Understanding these opportunities and adapting investment strategies accordingly is crucial for long-term success in the evolving real estate landscape.

Read more about Climate Risk and Real Estate Returns: Understanding the Correlation

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy