AI in Real Estate: From Transaction to Transformation

The Rise of AI in Property Valuation

The Impact of Data on Valuation

Modern property valuation is undergoing a transformation fueled by unprecedented access to diverse data sources. From live transaction records to subtle shifts in neighborhood sentiment captured through digital footprints, this revolutionary approach enables valuations that reflect the true pulse of the market, leaving behind outdated methods constrained by historical limitations.

Sophisticated analytical tools now parse through terabytes of information, detecting nuanced relationships that escape human perception. By decoding these complex market interconnections, valuation professionals gain multidimensional insights, resulting in assessments that are both precise and contextually aware. This paradigm shift is establishing new standards for reliability in property appraisal.

Advanced Predictive Models

The valuation landscape now incorporates self-improving analytical systems that continuously refine their predictive capabilities. These intelligent models digest historical patterns while adapting to emerging trends, creating valuation forecasts with impressive consistency.

Various computational approaches, from multivariate regression to deep learning architectures, process disparate data streams to produce increasingly sophisticated estimates. This technological evolution represents a fundamental change in how we approach the science of real estate valuation.

Revolutionizing Valuation Timelines

Contemporary valuation platforms have dramatically compressed assessment timelines. By automating complex analytical processes, these systems deliver comprehensive valuations in timeframes that redefine industry expectations, providing unprecedented responsiveness for time-sensitive decisions.

This acceleration particularly benefits market participants requiring rapid assessments for acquisitions, portfolio evaluations, or development feasibility studies, where traditional timelines often created operational bottlenecks.

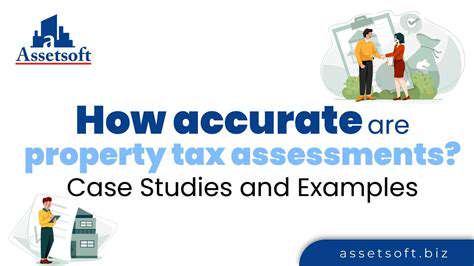

Precision in Valuation Science

Modern analytical models, trained on expansive historical datasets, frequently demonstrate superior accuracy compared to conventional appraisal methods. Their ability to process countless variables and their complex interactions enables detection of subtle market shifts and more reliable future projections.

This heightened precision results in valuations that more accurately reflect true market conditions, minimizing the financial risks associated with incorrect assessments. All parties in real estate transactions stand to gain from this increased valuation reliability.

Dynamic Market Responsiveness

Continuous data integration, incorporating live market metrics, economic developments, and emerging societal patterns, forms the foundation of modern valuation systems. This constant stream of current information allows for valuations that adapt fluidly to market evolution.

Valuations now represent living analyses rather than static reports, maintaining relevance amidst market volatility. This dynamic adjustment capability is essential for navigating today's rapidly changing real estate environments.

Addressing Implementation Challenges

While offering substantial benefits, these advanced valuation systems present unique challenges. Maintaining data integrity and preventing algorithmic bias remain critical considerations for ethical implementation.

Additionally, the complexity of these systems can create transparency concerns. Developing clear explanations of valuation methodologies is crucial for establishing confidence in these advanced tools.

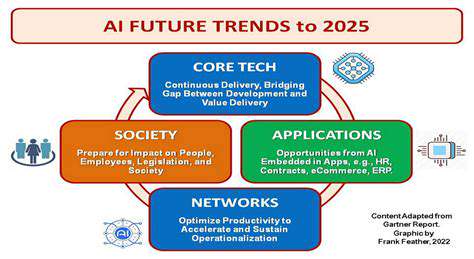

Emerging Technological Synergies

The convergence of valuation technology with distributed ledger systems and smart sensors hints at future possibilities. These integrations promise even more refined, efficient, and verifiable valuation processes.

The trajectory of property valuation clearly points toward increasing technological integration. As these systems mature, we can anticipate near-instantaneous valuations, unparalleled accuracy, and seamless integration throughout real estate operations.

Streamlining the Transaction Process with AI

Workflow Optimization Strategies

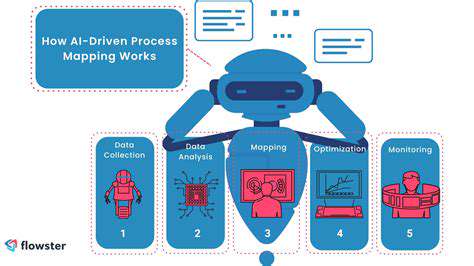

Modern transaction processing requires holistic refinement, addressing efficiency barriers across all operational phases. This involves comprehensive process evaluation, constraint identification, and solution implementation to expedite the complete transactional lifecycle. Enhanced operational flows minimize delays and elevate client experiences - critical advantages in today's demanding marketplace. Detailed process mapping enables organizations to identify optimization opportunities and enact meaningful productivity improvements that transcend simple automation, encompassing communication infrastructure, information management, and role clarity.

Operational integrity depends on implementing robust verification frameworks. These protocols safeguard accuracy, regulatory compliance, and data security throughout transactions. Establishing clear standards for information verification, approval hierarchies, and validation procedures reduces errors while preventing financial misconduct. Periodic system reviews and performance evaluations maintain protocol effectiveness, allowing for timely refinements that preserve operational excellence.

Communication Infrastructure Enhancement

Effective information exchange forms the backbone of efficient transaction processing. This requirement applies equally to interdepartmental coordination and external stakeholder engagement. Unified communication platforms ensure all participants remain consistently informed about transaction progress, fostering transparency that builds confidence and prevents miscommunication.

Implementing comprehensive communication tracking systems guarantees comprehensive documentation. Solutions may include threaded message systems, specialized management software, or dedicated transaction channels. Consolidating these communication streams provides teams with complete visibility into transaction status, enabling superior coordination and a more efficient transactional experience.

Technological Integration

Digital solutions are redefining transaction efficiency. Automating routine operations like data capture and document handling dramatically reduces manual effort, allowing personnel to focus on strategic priorities. Beyond efficiency gains, this automation enhances accuracy by minimizing human error in critical processes.

Cloud-based collaborative platforms transform information accessibility, enabling real-time updates and team coordination. This universal access empowers stakeholders to review and modify information from any location, facilitating accelerated decision-making. Advanced analytical tools provide valuable operational insights, identifying process patterns that inform continuous improvement initiatives.

Security Framework Strengthening

In our digital era, transaction security demands rigorous protection protocols. Comprehensive security measures are essential for safeguarding sensitive information against unauthorized access and fraudulent activity. This requires multifactor authentication systems, advanced encryption standards, and regular vulnerability assessments.

Implementing layered authentication and end-to-end encryption protects confidential data integrity. Stringent access management combined with ongoing security training reinforces organizational defenses against digital threats, reducing vulnerability while ensuring regulatory compliance.

Read more about AI in Real Estate: From Transaction to Transformation

Hot Recommendations

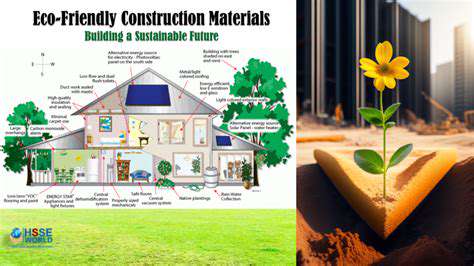

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy