AI Driven Valuation: The Competitive Edge You Need

Beyond the Balance Sheet: Unveiling Hidden Value

Traditional financial metrics, such as revenue and profit margins, often provide a limited view of a company's true potential. AI-powered valuation models can delve deeper, analyzing vast datasets to identify hidden assets and opportunities that may not be reflected in conventional accounting. This includes factors like brand reputation, customer loyalty, and the potential for future innovation, all of which contribute significantly to long-term value but are often overlooked by traditional methods. This deeper understanding allows for a more holistic evaluation of a company's worth, moving beyond the static figures of a balance sheet.

By analyzing patterns in customer behavior, market trends, and competitor activity, AI can predict future revenue streams and identify potential risks. This predictive capability is crucial for accurately assessing the future value of a company, allowing for a more nuanced and comprehensive evaluation of its overall potential.

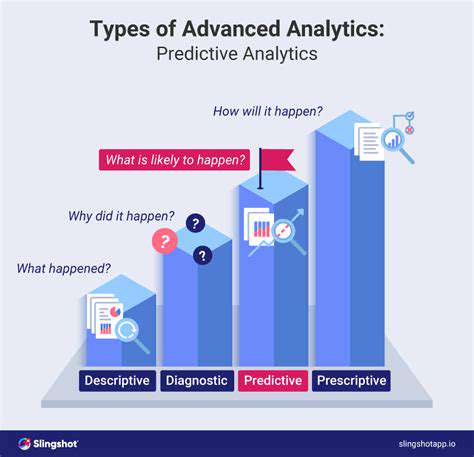

Predictive Modeling for Future Performance

AI algorithms excel at identifying patterns and relationships within complex data sets, a capability that is instrumental in predicting future performance. By analyzing historical data, current market conditions, and industry trends, AI models can project future revenue, profitability, and growth rates with a higher degree of accuracy than traditional forecasting methods. This predictive power is invaluable for investors seeking to understand the long-term viability and potential of a company.

This predictive modeling goes beyond simple extrapolation. By incorporating variables like market sentiment, technological advancements, and regulatory changes, AI can provide more dynamic and realistic projections that anticipate potential disruptions or opportunities.

Identifying and Quantifying Intangible Assets

Intangible assets, such as brand recognition, intellectual property, and customer relationships, are increasingly important drivers of a company's value. Traditional valuation methods often struggle to quantify these assets, leading to an incomplete picture of a company's worth. AI-powered models, however, can analyze vast amounts of data to assess the value of these intangible assets, providing a more comprehensive and accurate valuation.

For example, AI can analyze social media sentiment to gauge brand perception, measure customer engagement across various platforms, and assess the strength of a company's intellectual property portfolio. This allows for a more holistic understanding of the company's value proposition, going beyond the limitations of traditional financial metrics.

Real-Time Market Response and Dynamic Adjustment

AI-driven valuation models offer the advantage of real-time adaptation to changing market conditions. Unlike static valuations, AI can instantly react to shifts in market sentiment, economic fluctuations, or regulatory changes, adjusting its analysis and projections accordingly. This dynamic capability is critical for staying ahead of market trends and making informed investment decisions in a constantly evolving environment.

Enhanced Due Diligence and Risk Assessment

AI can significantly enhance due diligence processes by automating and accelerating the analysis of vast amounts of data. This allows for a deeper understanding of a company's financials, operations, and competitive landscape, enabling investors to identify potential risks and opportunities with greater precision. AI algorithms can rapidly process and analyze large datasets, providing insights that would be impossible for humans to identify manually, particularly in complex or opaque industries.

By automating the identification and analysis of potential risks, AI can help to mitigate potential financial losses and ensure more informed investment decisions.

Improving Accuracy and Efficiency in Valuation

AI-powered valuation models offer significant improvements in accuracy and efficiency compared to traditional methods. By processing vast amounts of data and identifying complex patterns, AI can generate more precise and comprehensive valuations, reducing the potential for errors and biases inherent in manual processes. This increased accuracy is crucial for making informed investment decisions.

Furthermore, the automation of tasks associated with valuation, such as data collection, analysis, and reporting, significantly reduces the time and resources required for the process. This efficiency translates directly into cost savings and faster turnaround times, allowing for more nimble and agile investment strategies.

Social commerce is rapidly transforming the way consumers shop online. It's no longer just about browsing product listings on dedicated e-commerce platforms. Now, social media platforms are becoming integrated shopping destinations, allowing users to discover, research, and purchase products directly within their social feeds. This evolution is driven by the increasing integration of social media into our daily lives, and the desire for more personalized and engaging shopping experiences.

Personalized Valuation for Enhanced Decision-Making

Understanding Personalized Valuation

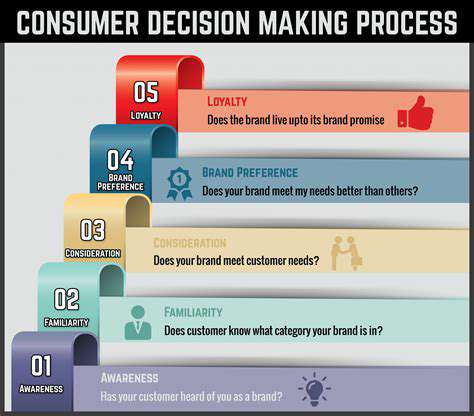

Personalized valuation is a crucial aspect of modern business, particularly in the digital age. It's about tailoring the assessment of an asset or entity to the specific needs and context of a particular individual or organization. This contrasts with traditional, one-size-fits-all valuation methods, which often fail to capture the nuances and complexities of individual situations. A key benefit of personalized valuation is its ability to provide a more accurate and relevant assessment, leading to better decision-making.

This approach recognizes that different factors influence the value of an asset for different stakeholders. For example, the value of a piece of land might differ significantly depending on whether the buyer intends to build a residential home, a commercial building, or a park.

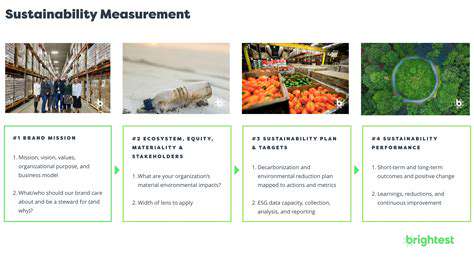

Factors Influencing Personalized Valuation

Numerous factors can influence the personalized valuation of an asset. These factors can be broadly categorized into market conditions, intrinsic characteristics of the asset, and the specific needs of the stakeholders involved. Understanding these factors is crucial to developing a robust and reliable valuation model.

Market trends, economic conditions, and industry-specific dynamics all play a role in determining the perceived value of an asset. Intrinsic characteristics such as quality, rarity, and condition also contribute significantly. Finally, the intended use, financial goals, and risk tolerance of the stakeholders are critical factors.

Applications of Personalized Valuation

Personalized valuation has a wide range of applications across various sectors. It's particularly valuable in investment banking, where tailored valuations of companies or assets are crucial for mergers and acquisitions (M&A) and financial modeling. In real estate, personalized valuations help determine the appropriate price for a property considering factors like location, size, and potential development opportunities.

Beyond these sectors, personalized valuation can be applied to intellectual property, collectibles, and even personal assets like art and antiques. In each case, the specific needs and circumstances of the individual or entity are considered.

Methods for Personalized Valuation

Various methods exist for developing personalized valuations. These methods often combine traditional valuation techniques with data analysis, market research, and expert opinions. Leveraging data analytics helps refine the valuation process by identifying trends and patterns within specific markets or industries.

For example, in the tech sector, personalized valuation might incorporate factors such as the company's market share, projected revenue growth, and intellectual property portfolio. These factors are then weighted based on their relevance to the specific needs of the individual investor or acquirer.

Benefits of Personalized Valuation

The primary benefit of personalized valuation is enhanced accuracy and relevance. By considering specific circumstances, personalized valuations provide a more accurate reflection of an asset's value than traditional methods. This leads to better decision-making and improved outcomes for stakeholders.

Furthermore, personalized valuation fosters transparency and trust. By clearly articulating the factors that influence the valuation, stakeholders gain a better understanding of the process and the rationale behind the final assessment. This can reduce potential disputes and improve overall satisfaction.

Challenges in Implementing Personalized Valuation

Despite the advantages, implementing personalized valuation presents certain challenges. One significant hurdle is the need for comprehensive data and expertise. Accurate valuation requires access to a wide range of data points and a deep understanding of the specific market dynamics involved. Ensuring data accuracy and consistency is crucial for reliable results.

Another challenge lies in the development and maintenance of robust valuation models that can adapt to changing market conditions and stakeholder needs. This requires ongoing monitoring, adjustments, and improvements to the models. Addressing these challenges is essential for maximizing the benefits of personalized valuation.

Read more about AI Driven Valuation: The Competitive Edge You Need

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy