AI for Real Estate Loan Origination

Enhanced Customer Experience through Personalized Service

Improving Customer Engagement

A key aspect of enhancing the customer experience is fostering meaningful engagement. This involves more than just transactional interactions; it's about creating opportunities for customers to connect with your brand on a deeper level. Engaged customers are more likely to become loyal advocates, driving positive word-of-mouth referrals and ultimately contributing to increased profitability. Creating interactive content, personalized recommendations, and dedicated support channels are crucial elements in achieving this.

Implementing strategies that prioritize customer input and feedback is essential. Gathering insights directly from customers allows businesses to understand their needs and preferences more accurately, enabling the development of tailored solutions and products. This proactive approach fosters a sense of value and importance, strengthening the customer-brand relationship.

Personalized Experiences

Tailoring interactions to individual customer needs and preferences is paramount for a positive experience. This can involve personalized recommendations, customized product suggestions, and targeted marketing campaigns. By understanding individual customer journeys, businesses can anticipate needs and offer proactive assistance, improving overall satisfaction.

Streamlined Processes

Efficient and straightforward processes are vital for a smooth customer experience. Simplifying checkout procedures, reducing wait times, and providing clear and concise information contributes significantly to customer satisfaction. Minimizing friction points in the customer journey, from initial contact to post-purchase support, is crucial for a positive experience.

Implementing user-friendly interfaces and intuitive navigation across all platforms is critical. This includes websites, mobile apps, and customer service channels. Easy access to information and clear instructions enhance customer satisfaction and reduce frustration.

Proactive Customer Support

Providing readily available and helpful support is a cornerstone of a positive customer experience. This includes quick response times, comprehensive FAQs, and easily accessible contact options. Offering multiple channels for support, such as phone, email, chat, or social media, allows customers to choose the method that best suits their needs.

Anticipating potential issues and proactively addressing them demonstrates a commitment to customer satisfaction. This proactive approach builds trust and reduces the likelihood of negative experiences.

Enhanced Communication Channels

Utilizing various communication channels allows for tailored interactions and increased accessibility. Offering multiple channels, like email, phone, chat, and social media, ensures customers can reach out in the way that best suits their needs and preferences. Providing prompt and helpful responses, regardless of the channel, is critical.

Data-Driven Insights

Leveraging customer data to gain insights into behavior and preferences is essential for optimizing the customer experience. Analyzing data allows businesses to identify pain points, understand customer needs, and tailor solutions accordingly. This data-driven approach enables businesses to personalize interactions and proactively address potential issues, leading to a more positive and personalized experience.

Implementing robust analytics tools to track customer interactions across various touchpoints provides valuable data for continuous improvement. This allows for the identification of trends, patterns, and areas for optimization.

Accessibility and Inclusivity

Ensuring inclusivity and accessibility in all aspects of the customer experience is crucial. This includes providing support in multiple languages, using accessible design principles for websites and applications, and offering accommodations for diverse needs. This commitment to inclusivity fosters a sense of community and strengthens brand loyalty.

The Future of Real Estate Lending: AI as a Catalyst for Growth

Disruptive Technologies Shaping the Landscape

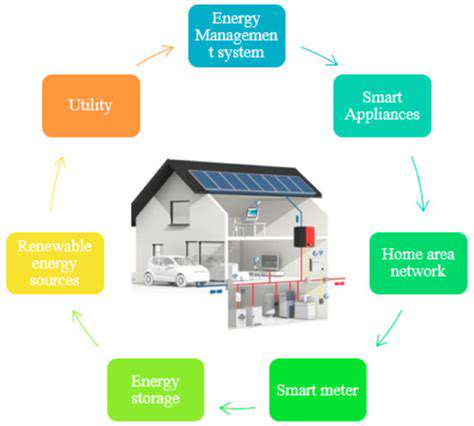

The real estate lending industry is undergoing a significant transformation, driven by innovative technologies. From AI-powered risk assessments to blockchain-based transaction platforms, these advancements are poised to revolutionize how loans are originated, processed, and managed. This shift promises increased efficiency, reduced costs, and enhanced transparency for all stakeholders.

These technologies are not simply automating existing processes; they are fundamentally altering the way lenders approach risk management, customer service, and overall operations. This is creating a more dynamic and competitive environment for both established players and new entrants.

Enhanced Risk Assessment through Data Analytics

Data analytics is playing a pivotal role in refining risk assessment models. Lenders are leveraging vast datasets encompassing credit scores, property values, market trends, and even social media activity to develop more accurate and comprehensive risk profiles for borrowers. This allows for more informed lending decisions, ultimately minimizing potential losses.

The ability to identify and analyze subtle patterns in data is crucial in identifying high-risk borrowers before they become problematic, preventing potential loan defaults and protecting lenders' interests.

Streamlined Loan Processing via Automation

Automation is streamlining loan processing, reducing the time it takes to complete a loan application. From initial credit checks to document verification, automated systems are handling many of the repetitive tasks, freeing up lenders to focus on more complex aspects of the process. This significantly reduces administrative overhead and increases the speed of loan approvals, benefiting both borrowers and lenders.

Blockchain Technology for Transparency and Security

Blockchain technology is offering new levels of transparency and security in real estate transactions. By recording all transaction details on an immutable ledger, blockchain can reduce fraud, minimize delays, and improve the overall efficiency of the entire lending process. This enhanced transparency builds trust and fosters greater confidence in the integrity of the entire system.

Furthermore, the decentralized nature of blockchain can potentially eliminate intermediaries, further streamlining the process and reducing associated costs.

AI-Powered Customer Service and Personalized Experiences

AI is transforming customer service in real estate lending. Chatbots and virtual assistants are providing instant answers to borrower inquiries, guiding them through the application process, and providing personalized support. This significantly enhances the customer experience.

These AI-powered tools enable lenders to provide tailored advice and support to borrowers, leading to higher satisfaction and potentially more loan applications.

The Role of Fintech Companies in Innovation

Fintech companies are driving significant innovation in real estate lending. They are developing cutting-edge technologies and providing alternative lending options to borrowers who may have been traditionally excluded from the conventional lending market. This is expanding access to credit for a broader range of individuals and families.

These companies are changing the dynamics of the industry by offering unique solutions and challenging established lending practices.

Regulatory Considerations and Ethical Implications

The rapid advancement of technology raises important regulatory considerations and ethical implications. As the industry adopts new technologies, there is a need for clear regulations to ensure fair practices, data privacy, and responsible use of these tools. This is especially important to protect consumers and maintain the integrity of the market.

The ongoing evolution of real estate lending will require a careful balance between embracing innovation and ensuring responsible application of these tools to maintain consumer trust and ethical standards.

Read more about AI for Real Estate Loan Origination

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy