AI and Real Estate Market Trend Prediction: Advanced Models

Introduction to AI in Real Estate Prediction

Understanding the Basics of Artificial Intelligence

Artificial intelligence (AI) is rapidly transforming industries worldwide, and real estate is no exception. AI encompasses a broad range of technologies, from machine learning algorithms to natural language processing, and these tools are being deployed to automate tasks, analyze data, and enhance decision-making processes in the real estate sector. Understanding the fundamental principles of AI is crucial for navigating the complexities of this evolving landscape. This includes comprehending how algorithms learn from data, identify patterns, and make predictions. AI's ability to process vast amounts of information quickly and accurately allows for insights that were previously unavailable.

AI's potential to streamline operations and improve efficiency in real estate is significant. By automating repetitive tasks, AI frees up human agents to focus on more complex and strategic endeavors. This allows for greater productivity and ultimately, better service to clients. Moreover, AI tools can help identify potential opportunities and risks, leading to more informed decisions.

Data Analysis and Predictive Modeling

Real estate transactions involve a multitude of data points, including property characteristics, market trends, and economic indicators. AI algorithms excel at analyzing this complex data to identify patterns and correlations that might be missed by human analysts. This data-driven approach allows for more accurate market analysis and prediction.

Predictive modeling is a critical aspect of AI in real estate. By analyzing historical data, AI can predict future market trends, such as price fluctuations, rental demand, and property values. This knowledge is invaluable for investors, developers, and real estate agents alike.

Automation of Real Estate Tasks

AI-powered tools are automating various tasks within the real estate industry. From automating property listings and generating property descriptions to streamlining property management and tenant screening, AI is streamlining operations and increasing efficiency. This automation leads to cost savings and improved efficiency for all stakeholders.

AI-powered chatbots are also rapidly becoming more sophisticated. These chatbots can handle basic inquiries, schedule viewings, and even provide preliminary information about properties. This frees up human agents to handle more complex situations, ultimately leading to improved customer service.

Enhanced Customer Experience

AI is significantly enhancing the customer experience in real estate. Personalized recommendations, tailored search results, and proactive communication are just a few examples of how AI is improving interaction with clients. Through tailored recommendations and proactive communication, AI is increasing engagement and satisfaction.

AI-powered tools can also provide 24/7 availability, enabling clients to access information and services at any time. This increased accessibility and responsiveness enhances the overall customer experience and builds trust.

Ethical Considerations and Future Trends

As AI increasingly integrates into the real estate sector, ethical considerations become paramount. Issues such as algorithmic bias, data privacy, and transparency need careful consideration. Ensuring equitable access to AI-powered tools and mitigating potential biases is crucial for responsible implementation.

The future of AI in real estate is promising. Advancements in machine learning and natural language processing will continue to drive innovation. Expect further integration of AI into every aspect of the real estate experience, from property valuation to transaction management.

Deep Learning Models for Market Analysis

Deep Learning Models for Stock Prediction

Deep learning models, particularly recurrent neural networks (RNNs) and convolutional neural networks (CNNs), offer significant potential for stock prediction. These models can analyze vast amounts of market data, including historical prices, volume, news sentiment, and social media trends, to identify patterns and predict future price movements. Their ability to learn complex relationships within data sets makes them potentially more accurate than traditional statistical methods. However, the complexity of these models can also make them challenging to interpret and potentially prone to overfitting.

Furthermore, the success of deep learning models in stock prediction hinges heavily on the quality and quantity of the input data. Robust data preprocessing and feature engineering are crucial for achieving reliable results. Poor data quality can lead to inaccurate predictions and potentially misleading conclusions.

Recurrent Neural Networks (RNNs) in Market Analysis

RNNs, a type of deep learning architecture, excel at processing sequential data, which makes them particularly well-suited for financial market analysis. These networks can capture the temporal dependencies and patterns within time series data, such as stock prices over time. RNNs are adept at identifying trends and potentially predicting future price movements based on historical patterns.

Long Short-Term Memory (LSTM) networks, a specialized type of RNN, are particularly effective in capturing long-term dependencies in stock market data. This ability to remember past information allows them to make more accurate predictions than traditional models that struggle with the long-term memory problem.

Convolutional Neural Networks (CNNs) for Pattern Recognition

CNNs, another powerful deep learning architecture, are primarily designed for processing grid-like data, such as images. Although traditionally used in image recognition, their ability to identify patterns in data can be leveraged for stock market analysis. These networks can analyze charts and graphs of financial data, extracting features that might indicate potential trends or patterns.

By analyzing patterns in historical price charts and volume data, CNNs can potentially identify market trends that traditional methods might miss. These models can potentially identify complex patterns by using filters and layers to learn hierarchical representations of the data.

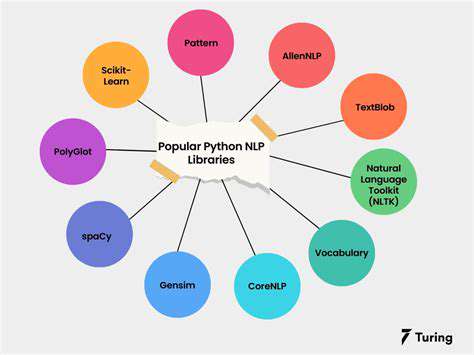

The Role of Natural Language Processing (NLP)

Financial news and social media sentiment analysis are critical for market prediction. Natural Language Processing (NLP) techniques, which are part of deep learning, can be used to extract insights from these textual data sources. NLP can analyze news articles, social media posts, and other textual information to gauge market sentiment and identify potential catalysts for price movements.

Analyzing the tone and sentiment expressed in news articles and social media posts can reveal valuable market insights. This data can be integrated with other data sources to potentially improve the accuracy of stock predictions. Sentiment analysis can provide a crucial layer of information beyond purely quantitative data.

Challenges and Limitations of Deep Learning Models

Despite their potential, deep learning models for stock prediction face significant challenges. Overfitting to training data, the difficulty in interpreting model predictions, and the need for substantial computational resources are important considerations. Overfitting can lead to models that perform well on historical data but fail to generalize to future market conditions. Moreover, the complex nature of deep learning models can make it difficult to understand the reasons behind their predictions, which limits the ability to use the insights effectively.

The high computational costs associated with training these models can also pose a significant barrier, especially for smaller investors or organizations with limited resources. A proper balance between model complexity and computational feasibility is crucial for practical application.

Machine Learning Algorithms for Predictive Modeling

Supervised Learning Algorithms

Supervised learning algorithms are crucial in predictive modeling for real estate. These algorithms learn from labeled data, where each data point is associated with a known outcome. For example, we might have a dataset of houses with features like size, location, and number of bedrooms, along with their sale prices. Supervised learning models can then be trained to predict the sale price of new houses based on their characteristics. Different supervised learning methods, like regression (for continuous outcomes like price) and classification (for categorical outcomes like property type), are employed depending on the specific prediction task.

Linear Regression, a fundamental supervised learning technique, establishes a relationship between independent variables and a dependent variable. In real estate, this could involve using features such as square footage, lot size, and proximity to amenities to predict house prices. However, its limitations include handling complex relationships inadequately. Other supervised models like Support Vector Machines (SVMs) offer a more sophisticated approach to complex non-linear relationships, leading to potentially more accurate predictions in the real estate market.

Unsupervised Learning Algorithms

Unsupervised learning algorithms are valuable for identifying hidden patterns and structures within real estate data. These algorithms work with unlabeled data, meaning the outcome variable is unknown. For instance, clustering algorithms can group similar properties based on features like location, amenities, and property type. This clustering can reveal distinct segments within the market, allowing for targeted marketing strategies and identifying undervalued or overvalued properties.

Principal Component Analysis (PCA) is a popular unsupervised learning technique used to reduce the dimensionality of the data while retaining most of the variance. This is beneficial for real estate data which often includes numerous features. By reducing the number of variables, PCA simplifies the analysis and can improve the performance of predictive models by reducing noise and improving model interpretability.

Reinforcement Learning Algorithms

Reinforcement learning algorithms are designed to learn optimal actions through trial and error. In the context of real estate, these algorithms can be used to optimize investment strategies or pricing strategies. For example, a reinforcement learning agent could learn to adjust the pricing of a property based on market feedback and historical data, maximizing its return on investment.

Imagine an agent learning to adjust the pricing of a property in a competitive market based on past sales and current market trends, maximizing its return. This iterative process of trial and error allows the agent to optimize its strategy over time, adapting to changing market conditions. These models are particularly powerful in dynamic environments, where the real estate market is constantly evolving.

Model Evaluation and Selection

Choosing the right machine learning algorithm for predictive modeling in real estate requires careful evaluation and selection based on the specific problem. Metrics like R-squared, Mean Squared Error (MSE), and Root Mean Squared Error (RMSE) are crucial for assessing the performance of different models. Cross-validation techniques help ensure that the models generalize well to unseen data, avoiding overfitting to the training dataset.

Understanding the strengths and weaknesses of each algorithm is paramount. For example, while linear regression is relatively straightforward, it may not capture complex relationships in the real estate market. Complex models like gradient boosting, while potentially more accurate, require more computational resources and careful tuning to avoid overfitting. Careful consideration of both accuracy and interpretability is key to effective model selection.

Feature Engineering and Data Preparation

Data preparation and feature engineering are vital steps in the machine learning pipeline for real estate. Real estate data often contains missing values, outliers, and inconsistencies. Proper data cleaning and transformation techniques are essential to ensure the data quality and integrity necessary for accurate predictions.

Feature engineering involves creating new features from existing ones to improve the predictive power of the model. For example, combining property size and location data into a composite feature representing neighborhood desirability can enhance model accuracy. This process significantly improves model performance by focusing on relevant aspects of the data.

Ethical Considerations in Real Estate AI

The use of machine learning in real estate raises important ethical considerations. Bias in datasets can lead to discriminatory outcomes, potentially impacting vulnerable populations. Ensuring fairness and transparency in the algorithms and data used is crucial.

Careful consideration of ethical implications is necessary when deploying AI systems in real estate. Algorithmic bias can manifest as unequal outcomes for different groups, potentially leading to discriminatory practices. Transparency and explainability in the models are essential to build trust and ensure equitable outcomes in the real estate market. The ethical implications of AI in real estate cannot be overlooked.

Enhancing Accuracy and Reliability Through Ensemble Methods

Boosting Prediction Accuracy

Ensemble methods in AI significantly enhance the accuracy of real estate market predictions by combining the outputs of multiple individual models. This approach leverages the strengths of diverse algorithms, mitigating the limitations of any single model. By averaging or weighting the predictions from various models, ensemble methods often produce more robust and reliable estimations, reducing the impact of outliers and noisy data that can skew individual model outputs. This improved accuracy translates to more precise valuations, better investment strategies, and ultimately, more informed decision-making in the dynamic real estate market.

For instance, using a combination of regression models, decision trees, and support vector machines can create a more comprehensive and accurate prediction model than relying on any one method alone. This diversification in prediction approaches ensures a broader perspective on market trends and individual property values.

Handling Data Heterogeneity

Real estate data often exhibits significant heterogeneity, encompassing various factors like location, property type, size, and market conditions. Ensemble methods excel at handling this complex and varied data by allowing different models to focus on specific aspects of the data. This tailored approach can lead to a more holistic understanding of the market, as opposed to a singular, potentially flawed, perspective.

Different models might excel at capturing different nuances of the data. For example, one model might be highly accurate in predicting the impact of location on prices, while another model might be better at predicting the effect of size. By combining these models, the ensemble method can leverage the strengths of each, leading to a more complete and robust prediction of real estate values. This adaptability to diverse data types is crucial for achieving reliable results in real estate forecasting.

Improving Model Robustness

Real estate markets are inherently volatile, and predictive models need to be resilient to fluctuations and unexpected events. Ensemble methods contribute to the robustness of models by reducing the impact of individual model errors. By combining predictions from multiple models, the impact of any single model's miscalculation is minimized, resulting in a more stable and reliable prediction.

This robustness is especially valuable in the real estate market, where sudden shifts in demand or supply can drastically impact property values. Ensemble methods help to mitigate these unpredictable events and provide a more stable basis for investment decisions. The average of multiple predictions is often more accurate than the prediction from a single model, especially in the face of volatility.

Addressing Bias and Outliers

Real estate data can contain biases and outliers, which can skew the results of individual prediction models. Ensemble methods help to mitigate the effect of these problematic data points by combining multiple predictions. This combination often leads to a more balanced and accurate representation of the market, reducing the impact of potentially misleading individual observations.

By considering multiple perspectives and averaging predictions, ensemble methods can reduce the influence of outliers and biases inherent in the data. This improved data handling leads to more reliable and robust predictions, which are crucial for successful real estate investment strategies.

Enhancing Generalization Capabilities

Ensemble methods are particularly effective at improving the generalization capabilities of prediction models. This means that the models become more effective at predicting future market trends and property values based on the observed data. By learning from multiple perspectives, the model becomes better equipped to understand the underlying complexities of the real estate market.

Streamlining Model Development

The development of complex real estate prediction models can be time-consuming and resource-intensive. Ensemble methods can expedite this process by combining existing models or generating diverse models through techniques like bagging and boosting. This streamlined approach allows analysts to leverage existing expertise and rapidly develop sophisticated models with enhanced predictive power.

The ability to quickly create and refine models is a significant advantage in the rapidly evolving real estate market. By reducing development time, ensemble methods enable real estate professionals to adapt to changing market conditions more effectively, leading to more timely and accurate decision-making.

Read more about AI and Real Estate Market Trend Prediction: Advanced Models

Hot Recommendations

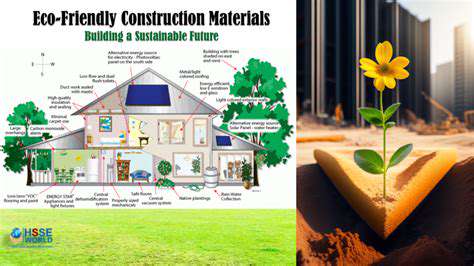

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy