AI Driven Real Estate Investment Insights: Advanced Analytics

Identifying Emerging Market Opportunities and Niche Investments

Identifying Emerging Market Opportunities

Emerging markets often present unique investment opportunities with the potential for high returns, but they also come with greater risk. Careful analysis is crucial to pinpoint areas with strong growth potential, such as sectors experiencing rapid technological advancements, expanding infrastructure projects, or growing consumer bases. Thorough research into local regulations, political stability, and economic forecasts is essential to mitigate risks and capitalize on the potential for significant gains. Understanding the nuances of each market is key to making informed investment decisions.

Niche Investment Strategies

Niche investments in real estate, particularly in specialized sectors like co-living spaces or senior living communities, can yield attractive returns. These specialized areas often cater to evolving demographics and lifestyle preferences, creating opportunities for tailored investment strategies. Detailed market research on the specific needs of the target demographic is crucial, as is understanding the competitive landscape and potential regulatory hurdles.

Another niche area involves investing in properties poised to benefit from technological advancements, such as smart home features or energy-efficient designs. Anticipating future demand for these amenities can lead to strong returns, but requires a forward-thinking approach and an understanding of technological trends.

Leveraging AI for Market Analysis

Artificial intelligence (AI) tools can play a critical role in identifying emerging market opportunities and niche investments. AI algorithms can process vast amounts of data, including market trends, demographic information, and economic forecasts, to identify patterns and predict future market behavior. This data-driven approach can help pinpoint promising areas with high potential for growth and avoid investments in markets with declining prospects.

Evaluating Risk and Reward

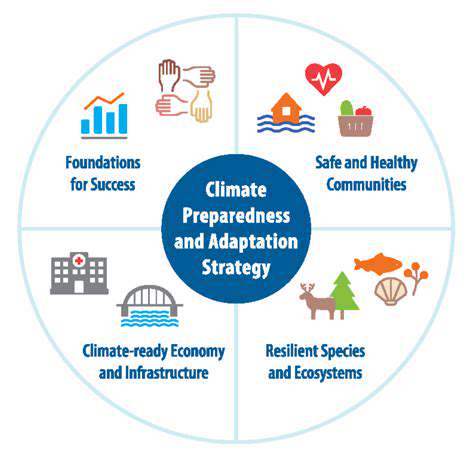

A crucial component of any investment strategy is a thorough evaluation of risk and reward. Emerging markets and niche investments often carry higher risk compared to established markets. Understanding the potential for both significant gains and substantial losses is essential to building a diversified portfolio that aligns with personal risk tolerance. Risk assessment needs to incorporate factors such as political instability, economic volatility, and regulatory changes.

Developing a Data-Driven Investment Strategy

A successful investment strategy relies heavily on data analysis. Using AI-powered tools to analyze real-time data from various sources, like social media sentiment and news articles, is vital for staying ahead of the curve. This proactive approach allows investors to adapt to evolving market conditions and make informed decisions based on current trends. This data-driven approach can be used to create a robust investment strategy tailored to specific market conditions.

Implementing and Monitoring Investment Performance

Implementing a sound investment strategy is only half the battle; rigorous monitoring and adjustments are equally important. Regularly reviewing investment performance against established benchmarks and adapting to changing market conditions is crucial for long-term success. This involves using data analytics tools and reporting mechanisms to track key metrics and identify potential areas for improvement. Proactive adjustments to the investment portfolio based on monitoring results are essential to ensure that the portfolio remains aligned with the investor's goals.

The Future of Real Estate Investment: Embracing AI

The Rise of Technology in Real Estate Investment

Technological advancements are rapidly transforming the real estate investment landscape. From sophisticated data analytics platforms to AI-powered property valuation tools, investors are leveraging technology to streamline processes, mitigate risks, and gain a competitive edge. These advancements are particularly valuable in identifying promising investment opportunities and assessing market trends with greater precision, leading to more informed decisions and potentially higher returns. The use of virtual tours and 3D modeling is also becoming increasingly prevalent, allowing potential investors to explore properties remotely and visualize their potential before committing to a purchase.

Furthermore, blockchain technology is poised to revolutionize real estate transactions. This decentralized system promises greater transparency and security, potentially reducing fraud and streamlining the closing process. Smart contracts, self-executing agreements coded on a blockchain, can automate various aspects of a real estate deal, creating a more efficient and trustworthy environment for all parties involved. This shift towards digital tools and processes is not just about convenience; it's about fundamentally altering how real estate investments are made and managed.

Investment Strategies for the Changing Market

The real estate market is in constant flux, and investors need to adapt their strategies to stay ahead of the curve. Understanding current trends, such as shifting demographics, evolving consumer preferences, and the impact of economic factors, is crucial for success. This adaptability is particularly important in navigating periods of economic uncertainty and making informed decisions aligned with long-term market projections. Investors should prioritize diversifying their portfolios across different property types, geographic locations, and investment vehicles to mitigate risk and maximize returns.

Analyzing market data and conducting thorough due diligence is paramount for identifying promising investment opportunities. Consider focusing on areas experiencing strong population growth or those with positive economic indicators, such as low unemployment rates and rising incomes. Furthermore, evaluating the local amenities and infrastructure, including schools, hospitals, and transportation networks, can significantly influence a property's long-term value and appeal to potential tenants or buyers. Thorough research and strategic planning are essential for navigating the complexities of the current real estate market.

Sustainable and Ethical Considerations

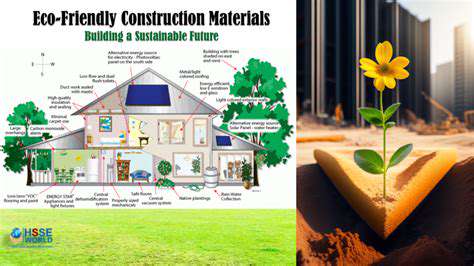

Environmental consciousness and social responsibility are increasingly influencing investment decisions in the real estate sector. Investors are now considering the environmental impact of their projects, seeking opportunities that promote sustainability, energy efficiency, and reduced carbon footprints. This includes prioritizing green building materials, renewable energy sources, and smart technologies to create more eco-friendly properties.

Ethical considerations are also gaining prominence. Investors are scrutinizing the social impact of their investments, ensuring they align with fair labor practices, community development, and environmental protection standards. This involves supporting projects that benefit local communities, create jobs, and promote inclusivity. These socially responsible investments are not only ethically sound but also demonstrate a long-term commitment to building sustainable and thriving communities.

Read more about AI Driven Real Estate Investment Insights: Advanced Analytics

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy