Climate Change and Real Estate Due Diligence

Regulatory Frameworks for Cryptocurrencies

The burgeoning cryptocurrency market necessitates a robust regulatory framework to ensure investor protection and market stability. Clear guidelines are crucial to prevent illicit activities like money laundering and terrorist financing. Different jurisdictions are adopting various approaches, ranging from outright prohibitions to comprehensive licensing regimes. This patchwork of regulations creates challenges for businesses operating across borders and necessitates international collaboration to establish consistent standards. The lack of a globally unified framework can hinder innovation and adoption of cryptocurrencies.

Regulatory bodies worldwide are grappling with the unique challenges presented by decentralized technologies. Successfully navigating this new terrain requires a nuanced understanding of the underlying technologies and the potential risks associated with their use. A key aspect is balancing the need for innovation with the need for consumer protection. This delicate balance necessitates ongoing dialogue and collaboration between regulators, industry stakeholders, and the public to ensure that regulations evolve alongside the rapidly changing landscape of cryptocurrencies.

Legal Challenges and Disputes

The legal landscape surrounding cryptocurrencies is still evolving, leading to numerous challenges and disputes. Defining the legal status of cryptocurrencies—are they securities, commodities, or something else entirely—is a significant hurdle. This uncertainty often fuels legal battles between investors and exchanges, and between governments and cryptocurrency companies. The lack of clear legal precedents for certain transactions and activities further complicates matters.

Jurisdictional differences in the interpretation and application of laws surrounding cryptocurrencies create further complexities. This can lead to inconsistencies in regulatory enforcement and create a fragmented legal environment. These disparities often create challenges for businesses operating across multiple jurisdictions and make it difficult to achieve a global consensus on the legal treatment of cryptocurrencies.

International Cooperation and Harmonization

The decentralized nature of cryptocurrencies necessitates international cooperation to establish consistent regulatory frameworks. Harmonizing regulations across different countries is essential to prevent regulatory arbitrage and promote market stability. This involves collaboration between regulatory bodies, industry stakeholders, and academics to identify common challenges and develop solutions that address the specific needs of the cryptocurrency market. Efforts to foster international cooperation and understanding are vital for the responsible growth of the cryptocurrency sector.

Effective international cooperation is vital for combating illicit activities that often exploit the anonymity associated with cryptocurrencies. This requires sharing information, developing joint strategies, and coordinating enforcement actions. Successfully addressing these challenges requires collaborative efforts to effectively prevent and deter illicit activities while fostering a secure and transparent ecosystem.

Emerging Trends and Future Directions

The cryptocurrency landscape is constantly evolving, with new technologies and applications emerging. Centralized exchanges are evolving into more decentralized platforms, and stablecoins are gaining prominence as a means of facilitating transactions. The rise of NFTs and other digital assets is further expanding the potential applications of cryptocurrencies, requiring a continuous review and adaptation of existing regulations. The future of cryptocurrency regulation will depend on how effectively regulators can adapt to these trends and keep pace with technological advancements.

The increasing use of cryptocurrencies in financial transactions and investments highlights the urgent need for robust and comprehensive oversight. The implications for national and international financial systems necessitate a proactive approach to regulating this emerging technology. The future of crypto regulation will likely involve greater emphasis on the security of digital assets and the prevention of financial crimes. This will likely lead to further development of international standards and frameworks.

Long-Term Investment Strategies and Adaptation Plans

Long-Term Investment Strategies for a Changing Climate

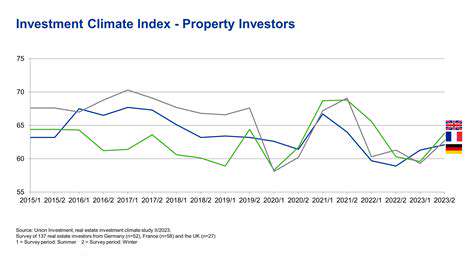

Adapting to climate change requires a proactive approach to long-term real estate investment strategies. Investors must consider the potential impacts of rising sea levels, extreme weather events, and shifting demographics on property values and rental income. This involves assessing risk factors specific to different geographic locations and property types, and actively seeking out properties with inherent resilience to environmental hazards. Diversification across regions and property types can help mitigate the impact of localized climate shocks, ensuring a more stable investment portfolio over time.

Assessing Climate Change Risk in Property Valuation

Accurate property valuation models must now incorporate climate change risk factors. This involves considering the potential for increased insurance premiums, reduced property value due to flooding or wildfire risk, and the impact of regulations and policy changes aimed at mitigating climate change. For example, coastal properties facing rising sea levels or increased storm surge risk will require a more nuanced assessment of their long-term value compared to properties in less vulnerable areas. Detailed analysis of historical climate data, projected future scenarios, and local regulations is crucial for informed decision-making.

Developing Adaptation Plans for Specific Properties

Individual properties need tailored adaptation plans to enhance resilience. This might include elevating structures in flood-prone areas, implementing drought-resistant landscaping, or installing flood mitigation systems. These measures not only protect the property's value but also contribute to the community's overall resilience. Careful consideration of the specific environmental vulnerabilities of each property is key to developing effective and cost-effective adaptation strategies.

The Role of Insurance and Risk Management in Climate-Resilient Investments

Comprehensive risk management strategies are essential for climate-resilient investments. This includes securing appropriate insurance coverage that accounts for climate-related risks. Investors should actively seek out insurers that offer specialized policies for properties located in high-risk areas. Utilizing predictive modeling and scenario analysis to anticipate potential climate-related damages can help investors to identify and manage risks proactively. This proactive approach allows for more informed decisions regarding insurance premiums and potential financial losses.

The Importance of Community Resilience and Infrastructure

Climate change impacts are interconnected and affect entire communities. Real estate investments must consider the resilience of local infrastructure and the overall community. This includes evaluating the adequacy of drainage systems, the effectiveness of emergency response plans, and the availability of public transportation. Investing in communities with strong infrastructure and robust disaster response plans can enhance the long-term value and stability of real estate investments.

Government Policies and Regulations Impacting Investment Decisions

Government policies, regulations, and incentives play a significant role in shaping climate-resilient investments. Investors need to stay informed about local, regional, and national policies related to climate change adaptation and mitigation. Understanding how these policies might affect property values, zoning regulations, and development permits is crucial for making informed investment decisions. Following changes in legislation and regulations is vital to ensure compliance and maximize long-term returns while aligning with sustainability goals.

Read more about Climate Change and Real Estate Due Diligence

Hot Recommendations

- Sustainable Real Estate Design Principles

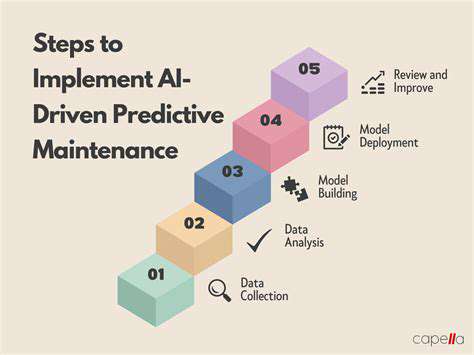

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

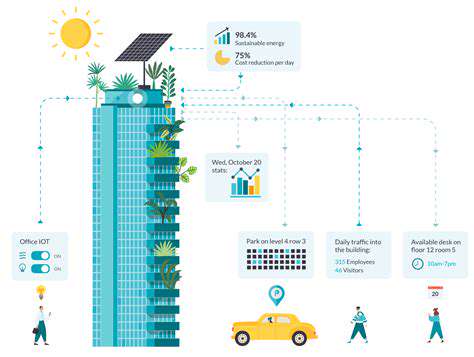

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy