AI for Real Estate Portfolio Risk Assessment

Optimizing Portfolio Diversification and Allocation

Understanding the Importance of Diversification

Diversification is a cornerstone of successful portfolio management, particularly in real estate. It mitigates risk by spreading investments across different asset classes, property types, geographic locations, and even investment strategies. This strategy helps to insulate your portfolio from the volatility of any single market or property type, ensuring more stable returns in the long term. A diversified portfolio is crucial in navigating economic fluctuations and unforeseen market shifts, providing a buffer against potential losses.

By diversifying your investments, you reduce the impact of a single poor-performing asset on the overall portfolio's performance. This is especially important in real estate, where market conditions can vary significantly across different locations and property types.

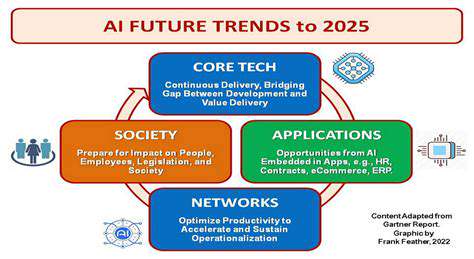

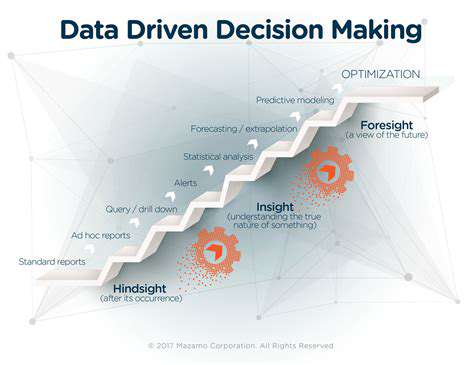

Leveraging AI for Data-Driven Insights

Artificial intelligence (AI) is revolutionizing investment strategies, and real estate is no exception. AI algorithms can analyze vast datasets of market trends, property valuations, and economic indicators to identify patterns and predict future performance. This data-driven approach enables investors to make more informed decisions regarding portfolio allocation and diversification.

AI-powered tools can quickly process information that would take humans significant time and effort. This efficiency allows for a more agile approach to portfolio management, enabling faster adjustments to changing market conditions and opportunities.

Optimizing Property Type Allocation

AI can help determine the optimal allocation of capital across various property types. Analyzing historical data and current market trends, AI can suggest the proportion of investment in residential, commercial, or industrial properties, and even specialized sectors like hospitality or student housing. By tailoring the allocation to current market conditions, AI can help maximize returns while managing risk.

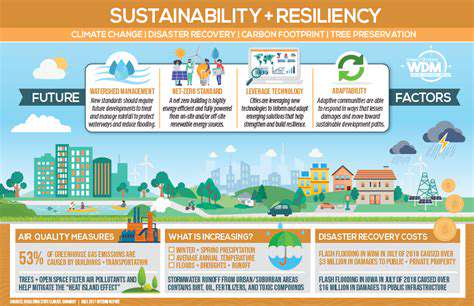

Geographic Diversification Strategies

Geographic diversification is another key aspect of portfolio optimization. AI can identify promising markets across different regions, considering factors like population growth, economic stability, and local regulations. This analysis can help investors allocate capital to regions that show high potential for growth and stability, thus enhancing the overall portfolio's resilience to regional downturns.

Assessing and Managing Risk

AI algorithms can effectively assess and manage risk within a real estate portfolio. By analyzing historical data, current market conditions, and potential future scenarios, AI can identify potential risks and suggest mitigation strategies. This proactive approach to risk management can help investors avoid significant losses and maintain the long-term stability of their portfolio.

Implementing Dynamic Portfolio Adjustments

Real estate markets are dynamic, and AI can help implement dynamic adjustments to your portfolio. As market conditions change, AI can provide real-time insights and recommendations for rebalancing your portfolio. This responsiveness to market fluctuations is critical for maximizing returns and minimizing potential losses. The ability to make quick and informed adjustments is a key advantage of using AI in portfolio management.

The Role of AI in Real Estate Portfolio Rebalancing

AI plays a crucial role in rebalancing real estate portfolios. As market conditions evolve, AI can identify assets that are underperforming or overperforming relative to the overall portfolio. This analysis enables investors to make necessary adjustments to maintain the desired diversification and risk profile. By automating this process, AI can ensure your portfolio remains aligned with your investment goals and risk tolerance.

Read more about AI for Real Estate Portfolio Risk Assessment

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy