AI for Commercial Real Estate Underwriting

The Future of Commercial Real Estate Underwriting with AI

AI-Powered Due Diligence: Streamlining the Process

Artificial intelligence (AI) is poised to revolutionize commercial real estate underwriting by automating and enhancing due diligence procedures. AI algorithms can analyze vast datasets, encompassing property valuations, market trends, tenant financials, and even environmental factors, significantly faster and more comprehensively than human analysts. This streamlined process allows underwriters to identify potential risks and opportunities more accurately, leading to better informed decisions and potentially higher returns on investment. By automating the initial stages of the underwriting process, AI frees up human analysts to focus on higher-level strategic considerations, such as complex negotiation and risk mitigation strategies.

Furthermore, AI can identify patterns and anomalies that might be missed by human reviewers. This predictive capability allows underwriters to proactively address potential issues before they escalate, leading to a more robust and secure investment portfolio. This proactive approach, enabled by AI's ability to process massive amounts of data, is crucial in today's dynamic market, ensuring underwriters stay ahead of emerging trends and make more informed decisions.

Predictive Modeling for Enhanced Risk Assessment

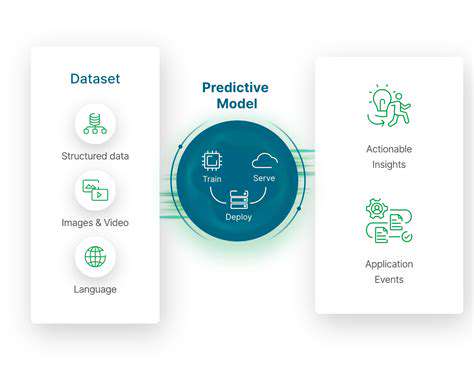

AI's predictive modeling capabilities are transforming risk assessment in commercial real estate. By analyzing historical data, market trends, and other relevant factors, AI models can forecast potential challenges and opportunities, such as tenant defaults, vacancy rates, and property appreciation. This predictive power allows underwriters to assess risk more accurately, potentially identifying and mitigating potential losses before they materialize. The ability to anticipate future market fluctuations based on historical data and current conditions is invaluable in the dynamic realm of commercial real estate.

These predictive models can also help underwriters tailor their investment strategies to align with specific market conditions and investor objectives. By understanding the potential for future returns and risks, underwriters can make more informed decisions regarding loan approvals, interest rates, and investment terms, optimizing their portfolios for long-term profitability. The use of AI in this capacity provides a powerful tool for navigating the complexities of the commercial real estate market.

AI-powered risk assessment tools can significantly reduce the time and cost associated with underwriting, while simultaneously enhancing the accuracy and efficiency of the process. Ultimately, this leads to greater investor confidence and a more stable and profitable market.

AI's ability to analyze vast amounts of data and identify complex patterns allows for a more comprehensive understanding of the market and the properties within it. This deeper understanding leads to more informed decisions and potentially greater returns for investors.

The integration of AI into commercial real estate underwriting is not just about streamlining the process; it's about fundamentally transforming the way we approach risk assessment and investment decisions.

Read more about AI for Commercial Real Estate Underwriting

Hot Recommendations

- Sustainable Real Estate Design Principles

- AI in Real Estate: Streamlining the Buying Process

- Climate Risk Disclosure: A Must for Real Estate

- Climate Risk Analytics: Essential for Real Estate Investment Funds

- Modular Sustainable Construction: Scalability and Speed

- Real Estate and Community Disaster Preparedness

- Smart Buildings and Advanced Building Analytics for Optimal Performance

- Smart Waste Sorting and Recycling in Buildings

- Sustainable Real Estate: A Strategic Advantage

- AI in Real Estate Transaction Processing: Speed and Accuracy